COVID19 lockdown period (April & May 2020) witnessed 3,250 transactions vs. 6,326 transactions in April & May 2019; however, numbers say that there was an increase of 27% in the median price per sqft compared to the same period in 2019. We should put figures in a context in order to make a rational investment decision.

It is important to keep in mind that property mortgage transaction values are not registered based on the actual property value; they are registered based on the mortgaged amount and depending on the type of mortgage, conventional or Islamic. Hence, to understand property prices change we should mainly consider the Sale Transactions and exclude the mortgage transaction from the equation.

Therefore, market performance or whether prices are going up or down is judged based on the property median price per sqft in the location of interest

April 2020

2,400 Property transactions were registered, 1.1k ready and 1.3k off-plan transactions. We notice a bigger decline in the ready property transactions than the off-plan because these off-plan transactions were transacted a few months ago and registered afterward mainly in Arabian Ranches III, Villanova, La Vie, Madinat Jumeirah Living, and Marina Vista Tower 1.

Also compared to April 2019, there was an increase of 34.6% in median property prices per sqft -- excluding mortgage transactions. This price increase can be attributed mainly to two factors:

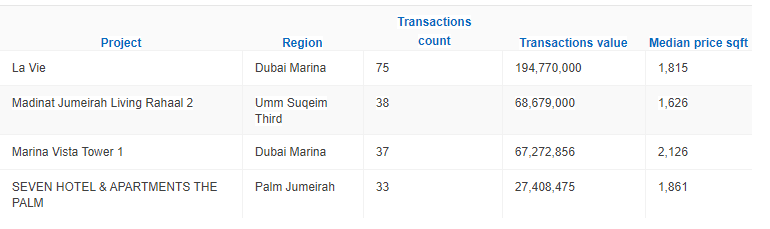

1- An increase in the prices of apartments in April 2020 where the majority of the transactions were in luxury areas such as:

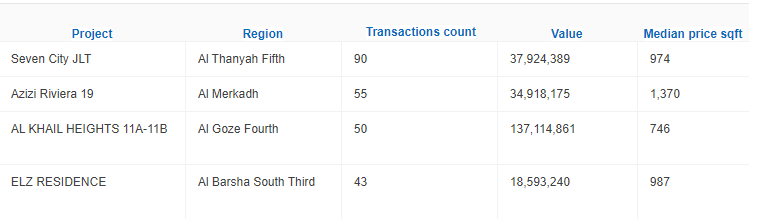

Vs. majority of transactions in April 2019 was in affordable areas such as:

2- Remarkable decline in the plot prices in April 2019 which made plot prices in 2020 appears to be higher.

May 2020

1,981 Property transactions were registered; as expected, the number of off-plan transactions went down to be 976 vs. 1,005 for ready properties. Even though the market started to open, we will witness a further decline in the off-plan transactions in the future. Compared to May 2019, in May 2020, there was an increase in property prices per sqft by 21% overall which, again, attributed to the fallacy of comparing the prices of different projects sold within the same timeframe. This increase should just push investors to further study the market in the area of interest. property-trends.com offers interactive tools that enable investors to get a deeper understanding of the property market in Dubai.

Mortgage Transactions

YTD there has been an increase in the mortgage transactions by 10.4% in 2020 compared to 2019; however, it looks like the market has not responded yet to the recent mortgage offers. The lockdown period witnessed a dramatic decrease of 55% i.e., in April, May 2020 there were 1,168 mortgage transactions vs. 2,602 in April, May 2019.

New Supply YTD

So far, in 2020, there have been 3,100 launched units composing 14 projects vs. 10,400 units (40 projects) in 2019. This a 70% decline in the number of launched units.

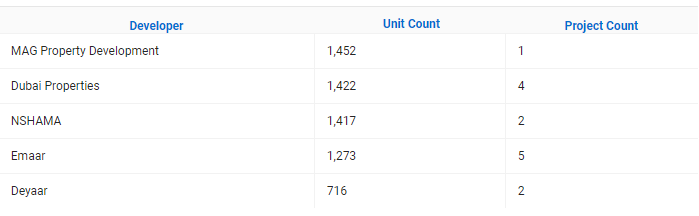

On the other hand, 13,743 units were completed in 2020 by top 5 developers are:

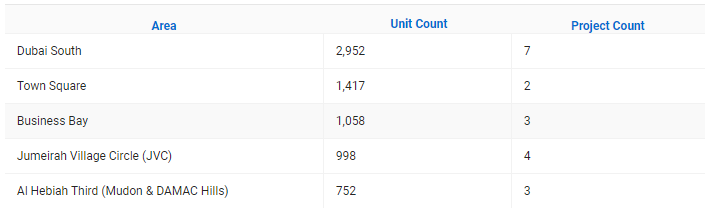

Top 5 areas to receive the new supply are:

By the end of 2020, we expect 17,800 units which have over 85% completion status to be delivered to the market mainly in Business Bay 3,327, Dubai Hills Estates (1,498), Akoya Oxygen (1,361), and Dubai Creek Harbour (1,254).

Conclusion

- There is a tendency toward luxury properties in April 2020 compared to April 2019.

- Investors should study mainly the property prices in a specific area instead of having a generic look at the entire market prices overall.

- You will sell your off-plan property in the secondary market, check the prices of the secondary market before buying an off-plan property.

- Comparing property market performance over time should be based on a full-year basis or at least six month period for two main reasons:

- The sharp seasonal fluctuation in the Dubai market, such as Ramadan, summer, and end of the year.

- To avoid the fallacy of comparing prices of different projects that sold within the same time frame.

Notes:

1- This study did not consider mortgage transactions.

2- Off-plan transactions are registered after a few months from the execution.