Dubai’s property market has smashed records in 2025—yet beneath the headlines lies a subtle shift. Is the boom turning into something more mature and sustainable, or is this just the first leg of a longer uptrend? In this article, I'll break down the data, trends, and signals so you see where we really stand in the Dubai real estate market 2025—and how to act on it.

Headline Numbers That Demand Attention

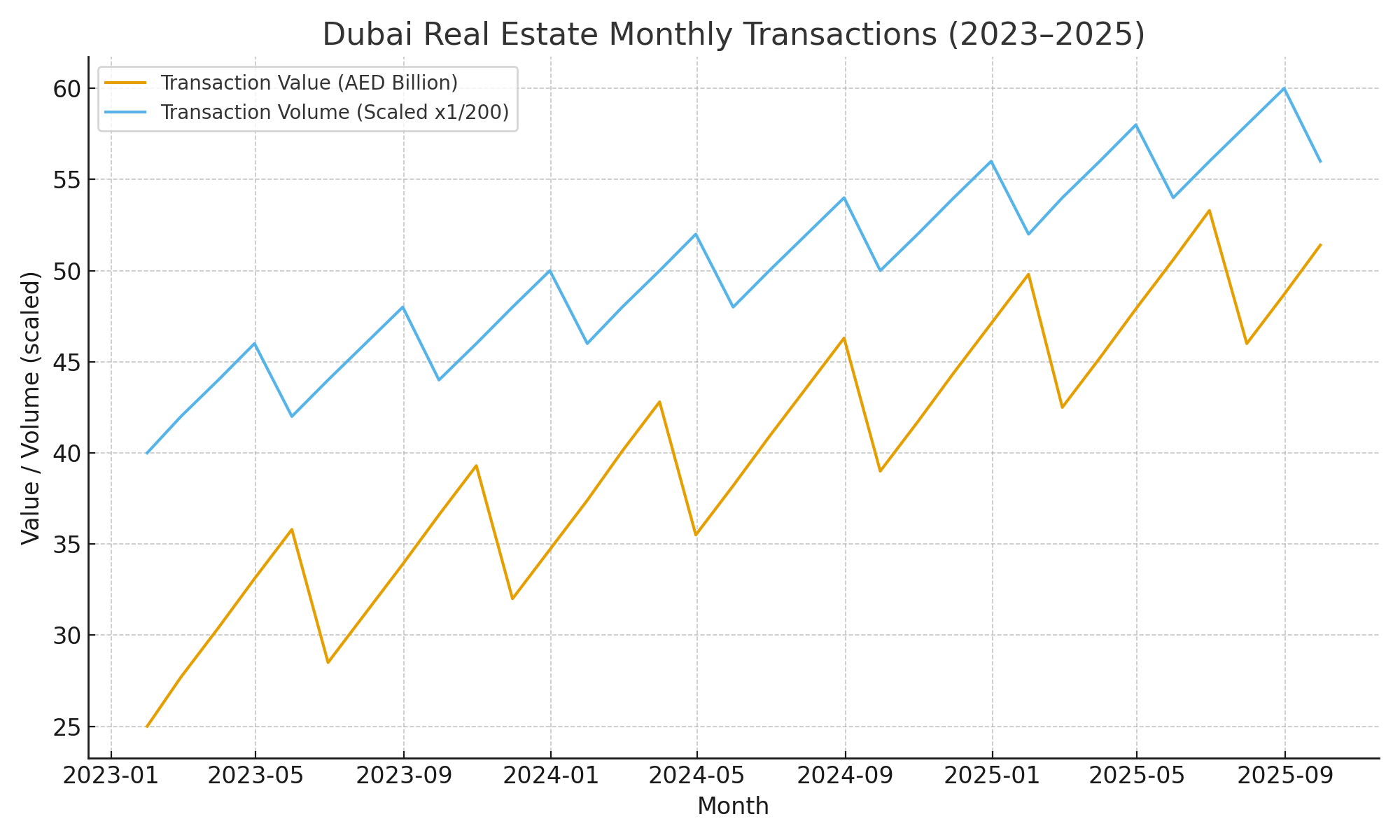

In April 2025, Dubai recorded AED 62.4 billion in real estate transactions—a 95% year-on-year increase. Villa, plot, and luxury asset sales led the surge, while the apartment segment showed signs of stabilization.

According to DXBinteract data in their yearly overview, ready villas saw a ~92% increase in sales value in 2025 versus 2024.

These figures suggest the boom is still real, but the nature of growth is evolving.

Maturing, Not Cooling: What the Shift Looks Like

From Momentum to Strategy

Previously, many buyers rode waves—entering early, exiting fast. Today, the focus is shifting to asset quality, location, and durability.

Investors are:

- Prioritizing prime / ultra-prime zones (Palm Jumeirah, Emirates Hills, etc.).

- Favoring ready or near-ready stock to reduce delivery risk.

- Avoiding speculative mid-tier towers.

- Choosing developers with track records and escrow transparency.

This is not a market pause—it’s a smartening phase.

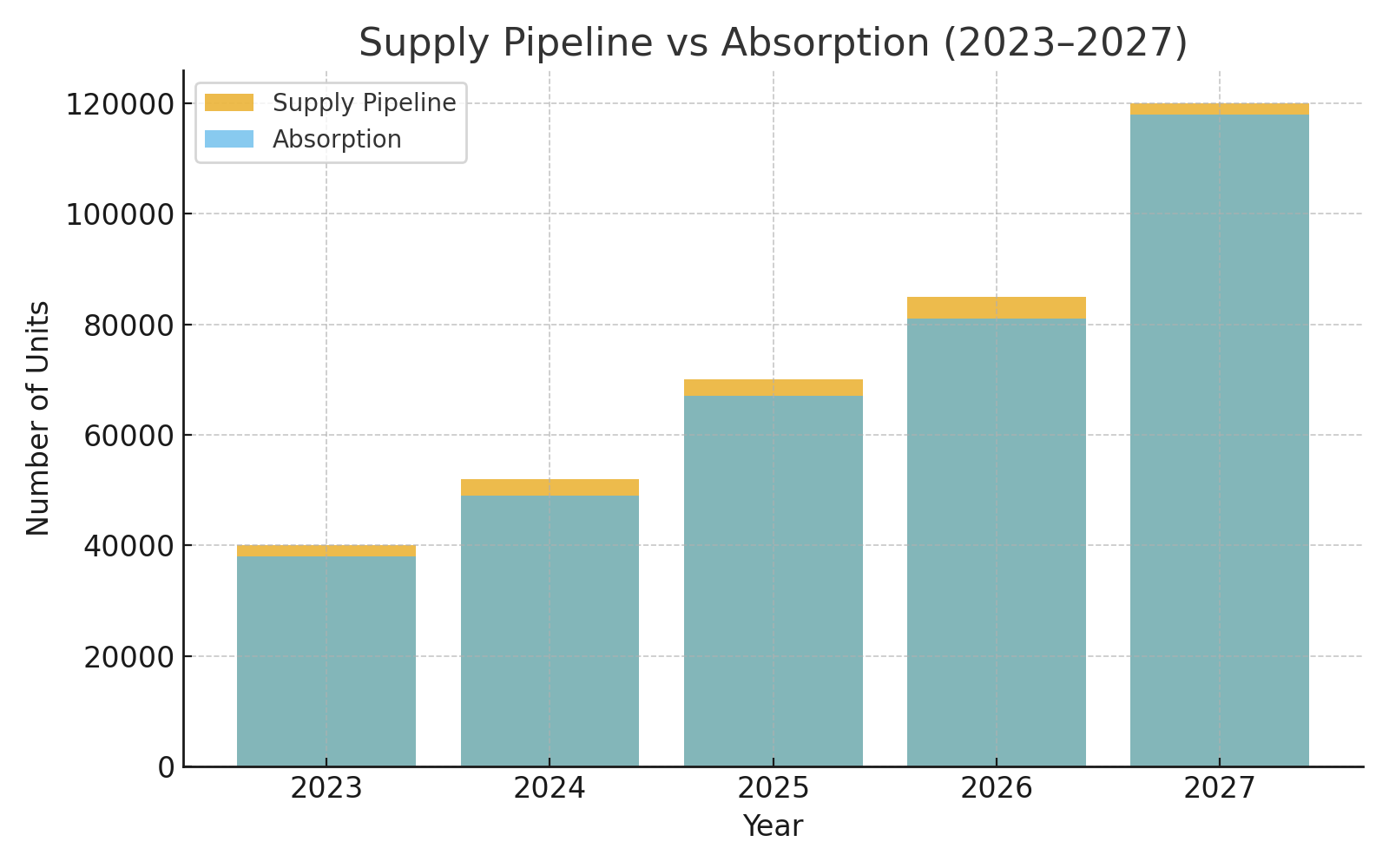

Strong Demand Meets Rising Supply

| Metric |

Insight |

| Supply Pipeline |

~300,000 new homes projected 2025–2029; villas represent only ~17% of that supply. |

| Absorption & Demand |

Global capital and end-users continue to drive absorption even as more units launch. |

| Luxury Strength |

Premium properties remain resilient, with steady pricing in top neighborhoods. |

Key Data Signals That Tell the True Story

Price Growth Moderation:

Quarterly gains now hover in the 4–6% band rather than double digits.

Resale vs. New Launch Ratio:

Resales are gaining share—a sign of market confidence in existing inventory.

Rental Yields:

Still attractive in core districts—hovering between 6% and 8%.

DXBinteract Area Pricing:

The platform shows average rates across Dubai between AED 1,100 – 1,400 per sq ft, varying by segment and zone.

These metrics all point to stabilized strength, not bubble behavior.

Risks You Must Guard Against

- Oversupply in Mid / Mass Apartments: Fitch has warned of a potential price correction up to 15% if supply outpaces demand.

- Flipping Fatigue: Those relying on quick flips are already seeing pressure in overbuilt segments.

- Delivery Delays & Project Risk: Projects without strong execution can be discounted sharply.

- Interest Rate Shocks / Liquidity Stress: Any macro turbulence will test mid-tier zones hardest.

Smart strategy equals positioning defensively within opportunity.

What This Means for Investors in 2025

Here’s how to approach Dubai luxury real estate investment in this evolving phase:

- Hold the top 10% locations—core assets likely outperform.

- Balance exposure—mix ready stock with selective off-plan.

- Let data lead decisions—use DXBinteract and verified analytics for filtering.

- Think long-term—large structural forces (pop growth, regulatory changes, global capital flows) are still in your favor.

- Maintain liquidity & flexibility—stagger entries, avoid full upfront overcommitment.

Final Thoughts

The real estate boom in Dubai is not over, but it’s changing character. We’re moving from high-octane acceleration to refined, sustainable expansion. But just because the tone changes doesn’t mean the opportunity fades.

Speak to fäm Properties today to decode the data, find your ideal entry point, and ride this next wave with confidence.