Introduction: The Market That Defied Predictions

In early 2024, many analysts warned of an upcoming price correction in Dubai’s property market. Some even forecast a “post-boom cooling” for villas and townhouses. Yet, by mid-2025, the opposite has unfolded — villa and townhouse prices are not only holding firm, but in many prime areas, they’ve surged to record highs.

This resilience is no accident. A powerful mix of limited supply, strong end-user demand, developer brand strength, and demographic growth has created a market segment that behaves very differently from the apartment sector.

Market Performance: Villas Outpace Apartments

While Dubai’s overall property market has grown steadily, villas have been the standout performer.

-

28.7% YoY price growth for villas by Q2 2025, compared to 19.1% for apartments.

-

Ultra-prime villa locations like Jumeirah Islands and Palm Jumeirah saw 40%+ annual price increases.

-

Even in early 2025, when the market saw a 0.6% price dip in January, villas quickly stabilized — showing this was a healthy pause, not the start of a downturn.

Transaction volumes tell the same story. In Q1 2025, villa sales transactions surged by 65% year-on-year, proving sustained buyer appetite.

The Supply Story: A Tale of Two Markets

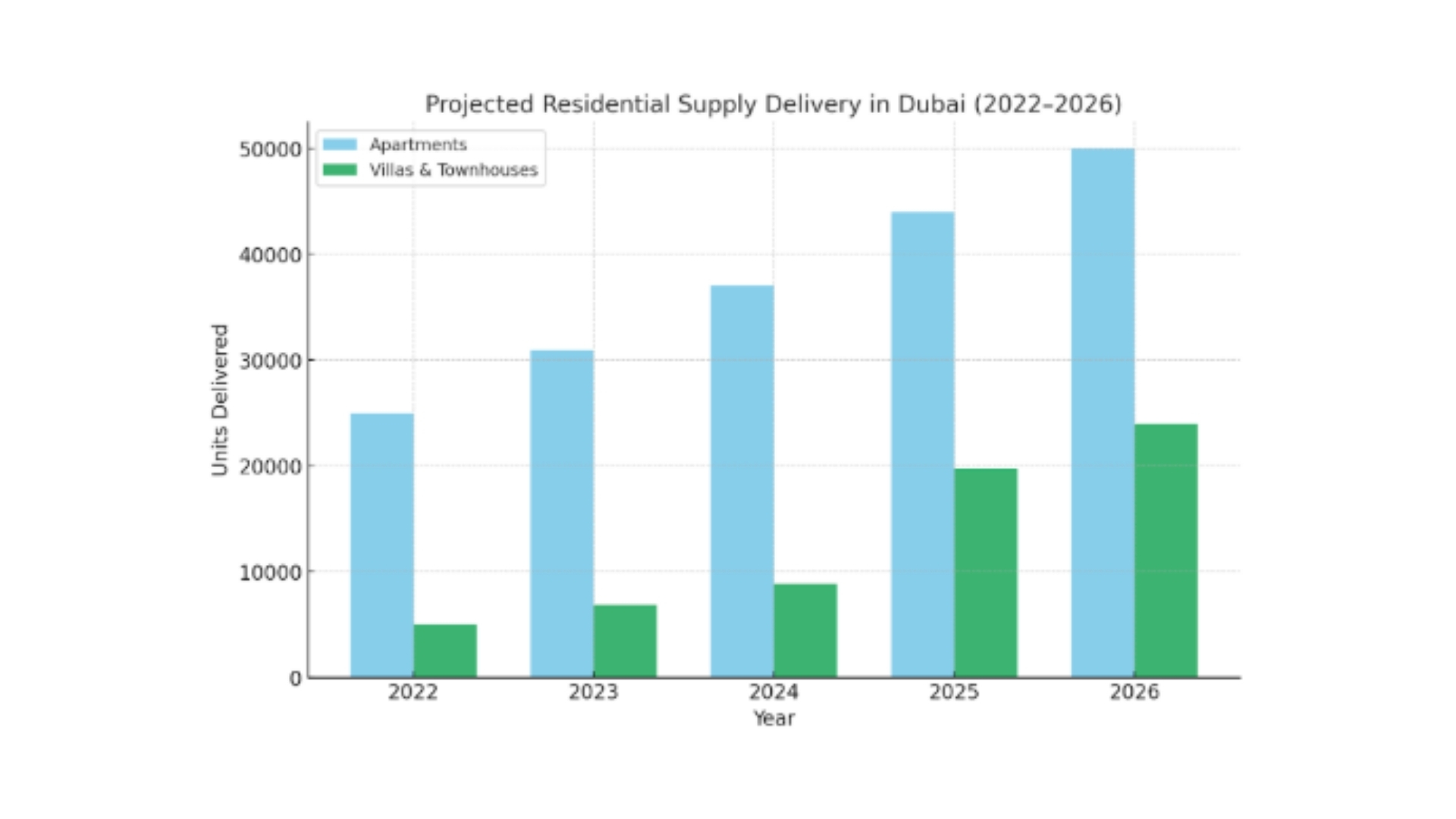

Headlines about Dubai’s “210,000 new units” miss a critical point — the supply is not balanced.

-

Apartments dominate: In 2024, 81% of all sales were apartments, while villas made up just 6% of total transactions.

-

Constrained villa pipeline: Only 8,900 villas were completed in 2024, with 19,700 expected in 2025 — a fraction of overall housing supply.

-

Land scarcity in prime zones: Communities like Palm Jumeirah, Dubai Hills Estate, and Jumeirah Bay have limited room for new villa projects, adding to their scarcity premium.

The result: apartments face higher competition and price sensitivity, while villas enjoy a supply shield that sustains values.

Four Pillars of Villa Market Resilience

1. Scarcity Premium

Limited villa deliveries mean demand consistently outpaces supply. In top-tier locations, this scarcity fuels aggressive bidding and record-breaking prices.

2. End-User Dominance

Unlike speculative-driven apartment segments, villas attract families and long-term residents. Mortgage-backed purchases are rising, signaling commitment beyond short-term flips.

3. Developer Brand Power

Emaar, DAMAC, and Nakheel dominate villa development, bringing with them proven delivery records, community infrastructure, and resale demand. Emaar, for example, held 15.8% market share in 2024 and continues to command price premiums.

4. Geographic Immunity

Micro-markets with ultra-limited land supply — Palm Jumeirah, Jumeirah Islands, Dubai Hills — remain insulated from oversupply risks, making them “safe havens” for capital.

Demographics Driving Demand

Two forces are expanding the villa buyer base:

-

Population Boom: Dubai added nearly 90,000 new residents in Q1 2025, double the pace of 2024. Many are families seeking larger, long-term homes.

-

Wealth Migration: The UAE is projected to attract 9,800 millionaires in 2025, the highest in the world. This influx directly fuels luxury villa demand, especially in exclusive waterfront and golf communities.

Investor Takeaways

If you’re considering entering Dubai’s villa or townhouse market, here’s why 2025 remains a compelling time:

-

Capital Growth Potential: Limited supply and growing HNWI demand keep upward pressure on prices.

-

Rental Stability: Family tenants in villas tend to sign longer leases, reducing vacancy risk.

-

Brand Assurance: Leading developers maintain high resale liquidity and rental demand.

Key Communities to Watch in 2025

-

Dubai Hills Estate – Master-planned luxury with schools, healthcare, and parks.

-

Palm Jumeirah – Trophy waterfront living with scarcity-driven value.

-

Jumeirah Islands – Record-breaking appreciation in 2024–25.

-

Arabian Ranches – Established suburban villas with strong resale history.

-

Damac Lagoons & Emaar South – Attractive entry points for first-time villa investors.

Conclusion: A Market Built on More Than Momentum

Dubai’s villa and townhouse segment isn’t just riding a market wave — it’s anchored by fundamental forces: constrained supply, demographic shifts, trusted developers, and a global luxury brand appeal.

While apartments may experience sharper ups and downs, villas continue to offer resilience, exclusivity, and long-term capital growth.

If you’re ready to explore villa investment opportunities in 2025, fäm Properties can help you identify high-potential projects, evaluate ROI, and secure the right deal in this competitive market.