Following the 2008 crash, stakeholders in Dubai’s real estate market have become more mature, careful and knowledgeable of the market and its dynamics. However, the lessons of 2008 seems to be fading away from many real estate investors who are making buying and selling decisions without obtaining the necessary data. This mistake results in uncalculated investment choices based on incomplete facts by commission oriented sales executives. Though Dubai's real estate market fundamentals are more stable, regulated, transparent and realistic as compared to 2008, we feel obligated as real estate experts to spread awareness and information towards enlightening all market stakeholders.

Before any property purchase or selling decision, what are the imperatives that investors should expect of real estate advisors and what shall investors refuse to accept from them? Particularly in a market where baseless fancy titles are provided to agents by many companies.Real estate investors shall refuse to be tricked by:

1- Agents who base their sales pitch primarily on 3D images, no fact sheet, internet replicated marketing text, fancy marketing headlines and overly exaggerated promises. Moreover, these agents use baseless techniques to pressure clients in making a decision.

2- Overwhelming outdoor media and online ads, following the general crowd, impressive brand image and good looking sales agents.

It is critical that the weight of the points mentioned above should not exceed 10% in the decision-making process. Real estate investors should primarily focus on a proper market analysis to understand:

• The market positioning of the project, in the light of its top 3 relevant market competitors, location, price, payment plan, features, incoming generating, justifiable anticipated capital appreciation on the entry price, supply and demand factor during construction and once completed. Know the developer’s delivery track record, construction progress, legal structure and mortgage availability.

• Does the entry, holding and exit strategy match the investor’s objectives and abilities?

Below is an example of a comparison table showcasing the undeniable facts of a promoted project and its conclusion:

Criteria | The Residence | Old Town | City Walk |

Price per sq. ft for the most attractive unit (view & layout | 3,000-3,300 AED/sq. ft | 2,500-2,800 AED/sq.ft | 1,900-2,200 AED sq.ft |

Price per sq. ft for the least desirable unit (view & layout | 1,800-2,000 AED/sq.ft | 1,600-1,800 AED/sq.ft | 1,500-1,700 AED/sq.ft |

Supply & demand (for associate buildings) | Modern High Rise- Strong demand vs strong supply | Moroccan Style, dull with small windows & natural light. Low supply vs low demand (low historical price appreciation as compared to other Downtown projects | Modern Low Rise-extremely limited supply vs a very high demand. (the only low rise in prime Dubai & the first freehold in Jumeirah area) |

Density of master community | Part of Downtown, which consists of 6000+ similar ranges of ready apartments; and more to come. | Although it is the only low rise project in Downtown; yet it’s still centrally located in a master community of 7,000+units | Part of a unique concept of ready 34 low rise modern buildings; having a total of only1,700 apartments with a minimal projection of similar leverage to happen |

Ongoing maintenance quality & master developer’s reputation | Best in Dubai | Best in Dubai | Best in Dubai and the “Future Image of the Country” |

Product finishing (rating out of 10) “within the same class of apartments & price range | 9 out of 10 (Depends on Which Building) | 7 out of 10 | 8 out of 10 |

Location and Accessibility | Downtown: Access to Burj Khalifa-The Fountain-Dubai Mall | Downtown: Access to MBR Boulevard-Dubai Mall-Business Bay | Jumeirah-Access to Downtown as a whole-Four Seasons Hotel- LA Mer Beach- Box Park-Bvlgari Hotel-Nikki Beach |

Anticipated Price Appreciation | Already completed-fluctuates with market index | Already completed-fluctuates with market index | Upon full maturity of the project, retail establishment& entertainment destinations completion; prices will skyrocket |

Project age | 9 years | 10 years | Brand New (Investors do not pay premium & End users are the first to occupy their homes |

Payment plan & financing | No payment plan- possibility of mortgage | No payment plan- possibility of mortgage | Post-handover payment plan on 24 month with finance incentive from all of Dubai banks |

Master Community | Popular tourist destination | Popular tourist destination | Unique cosmopolitan community with first time ever concepts |

Conclusion:

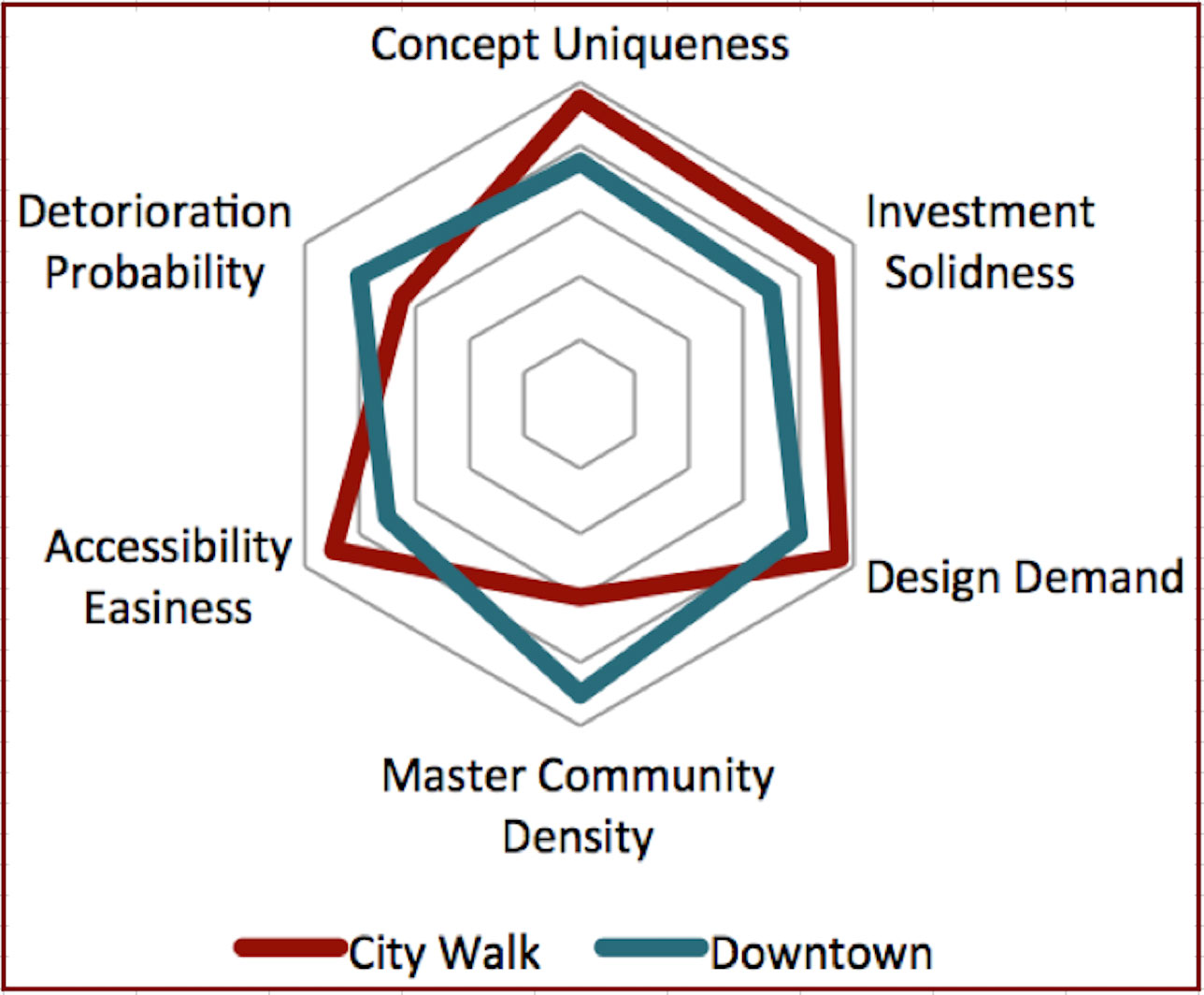

Based on concept uniqueness, investment solidness and livability smoothness, City Walk stands out.

Facts:

- City Walk average prices are 22% less compared to a combined Downtown average

- City Walk urban density is 73% less compared to Downtown

- City Walk price appreciation is granted while that of Downtown is uncertain

- City Walk demand is unpredictably high vs. a continuous Downtown supply

- City Walk accessibility is much effortless compared to Downtown

- City Walk is ten years younger than Downtown

Advice for Property Sellers

In contrast, property Sellers shall also refuse to be deceived by groundless pressure to sell at under market price. Sales agents who provide advice based on fears of a market crash or price fall should be able to support their opinion with substantial evidence such as a history of transactions records, price trend during the past 6 to 12 months, similar listed properties on the market and at what prices. A qualified sales agent must understand the mortgage procedure, banking process, RERA regulations and the after-sale process.

Firas Al Msaddi – CEO – fam Properties