It all started with firefighting the 2019 Pandemic:

When COVID-19 hit 2019, the Fed exhausted everything they have to combat the pandemic recession, to the extent of offering nearly zero interest rate. Lower interest rates motivated businesses to invest and borrow cheap money. It also encouraged hoe buyers— attracted by record low mortgage rates—to jump into the housing market.

But what the Fed was doing to help recovering the economy from the pandemic impact is now all behind us. The Federal Reserve has completely shifted into inflation-fighting mode.

The Fed announced the increase of 50 basis points this month

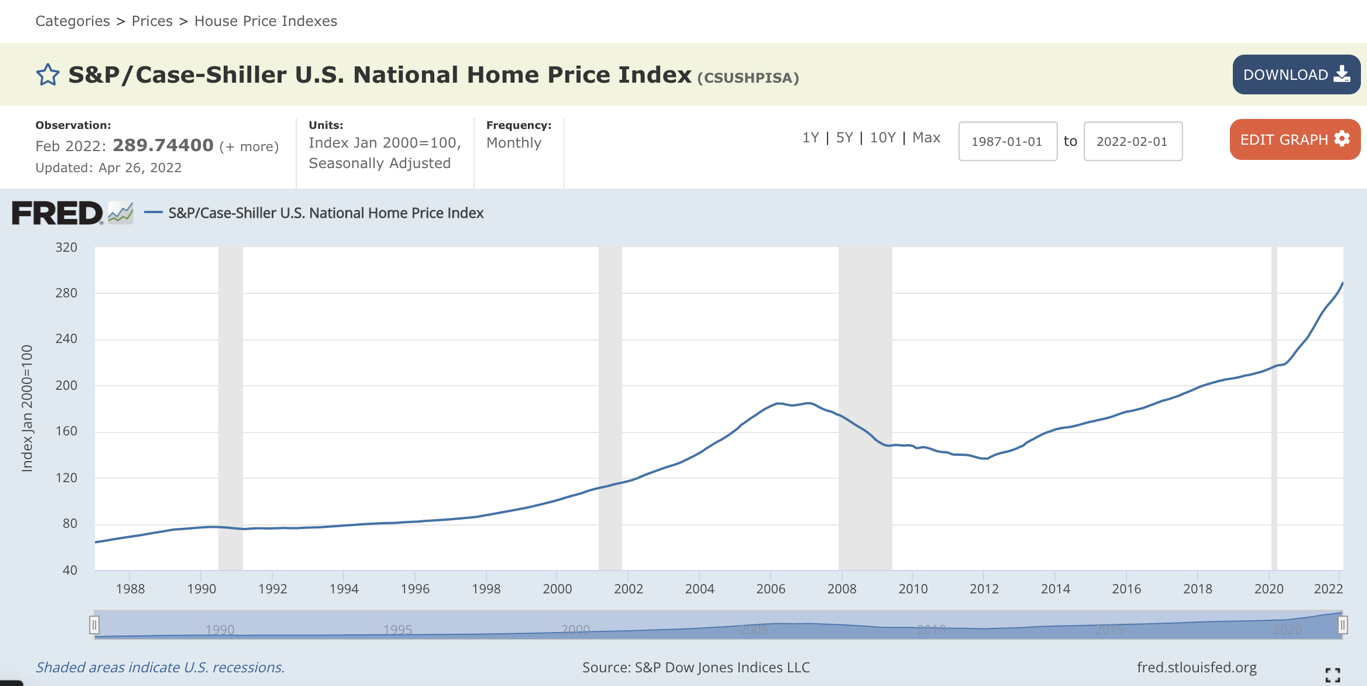

Shocking the real estate markets across the US and the EU. In the US, the interest rate on 30 years fixed mortgage was 3.11% it now hit 5.27% the highest ever since 2009. Which means banks have not just increased their mortgage interest rate but also have started making mortgage legibility harder and stricter than ever before which is indeed discouraging and disabling many mortgage buyers from entering the housing market.

Where do we go from here?

No one can be certain on how aggressive and how fast the Fed will continue to hike up the interest rate, although many anticipate to be the case, but that all depends on where the inflation goes next from now. In 1981, the average 30-year mortgage rate crossed over 18%—something that ultimately plunged the U.S. economy and housing market into recession.

Dubai housing market is more resilient than other global markets

Although Dubai Housing Market is not immune to the impact of the illness of the global economy, is likely to outperform all the housing markets across the US and the EU. Dubai has a very strong resilience against the interest rate risk for three main reasons:

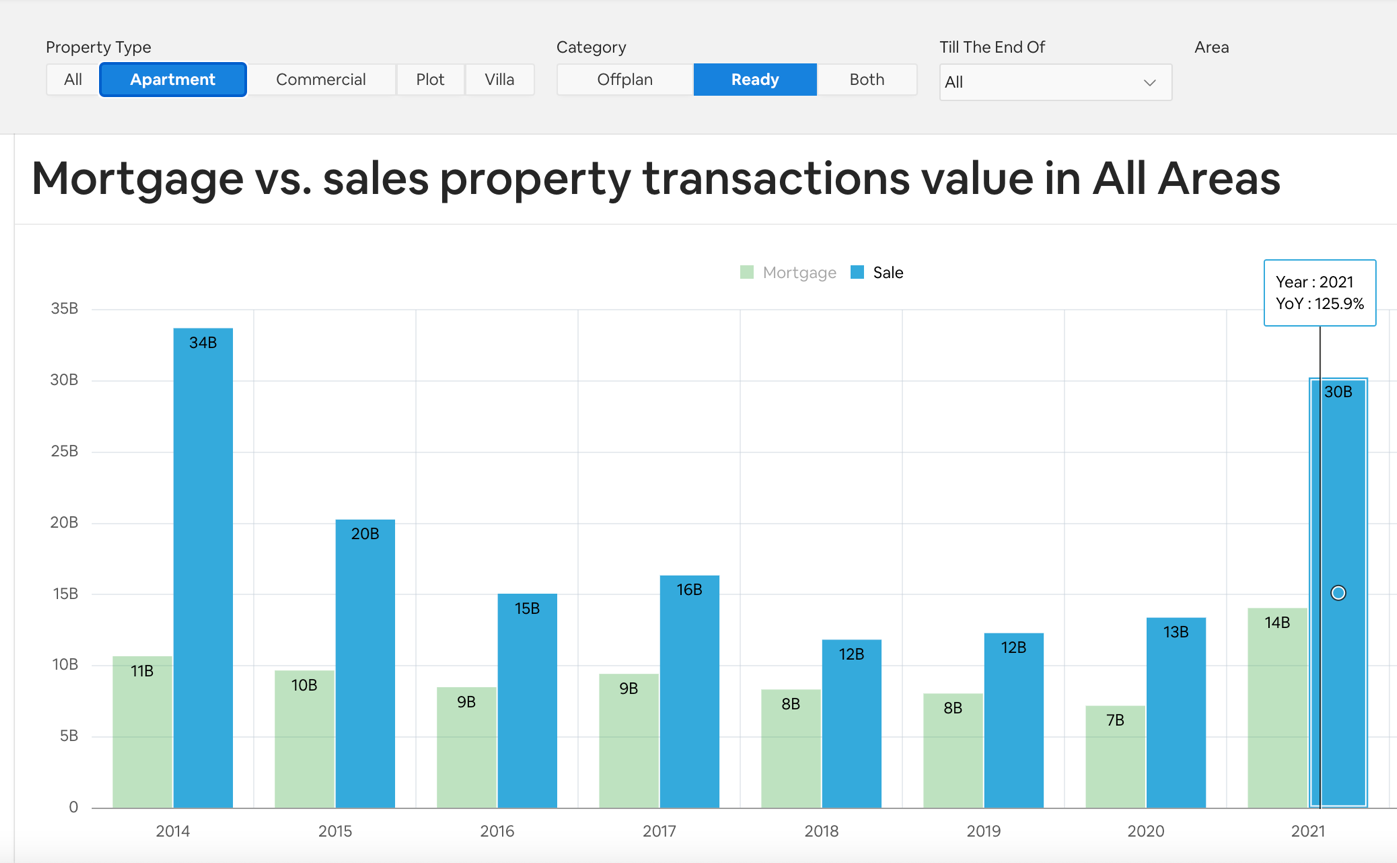

- Historically Dubai real estate market is not a mortgage driven market, as mortgage interest rates have been always more costly that what it is in the US and EU. Add to that mortgage in the EU is almost a pre-requisite strategy to help investors minimizing the cost all taxations. Whereas Dubai remains a tax free heaven for capital gain, rental income and inheritance.

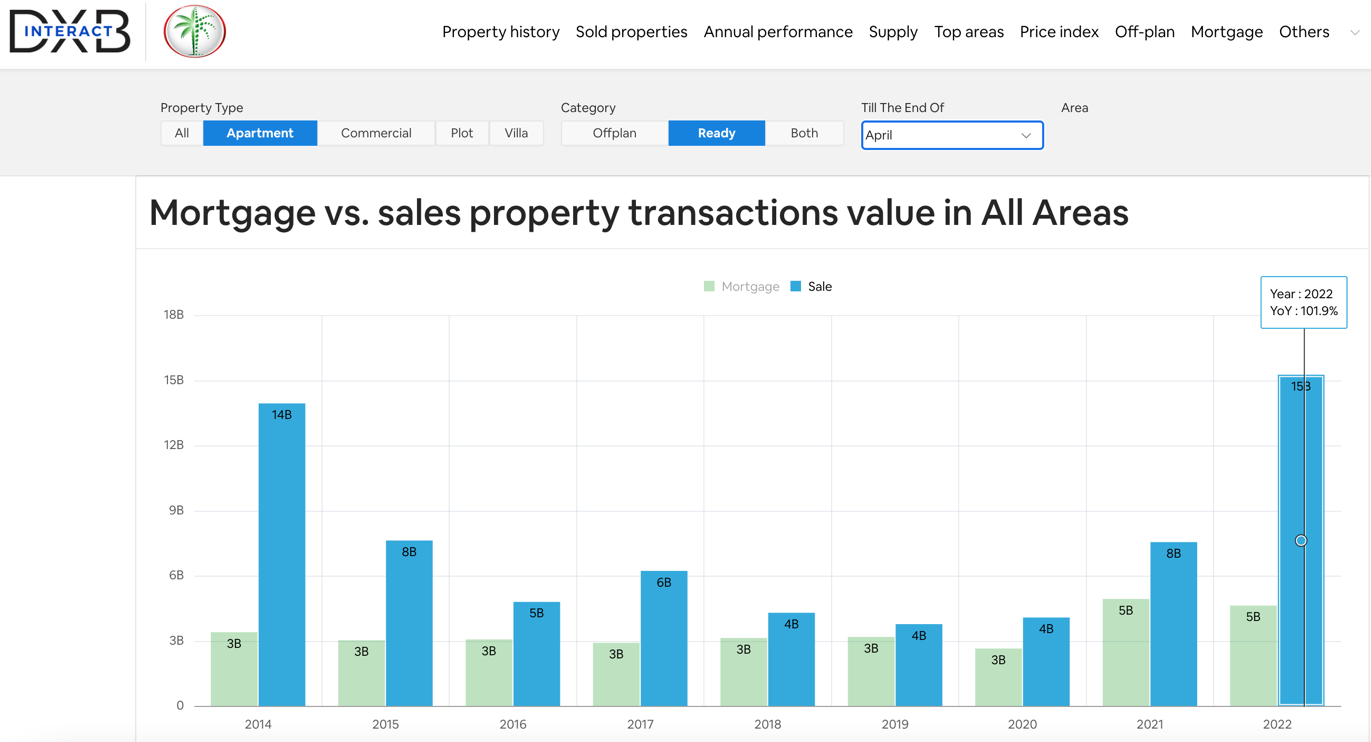

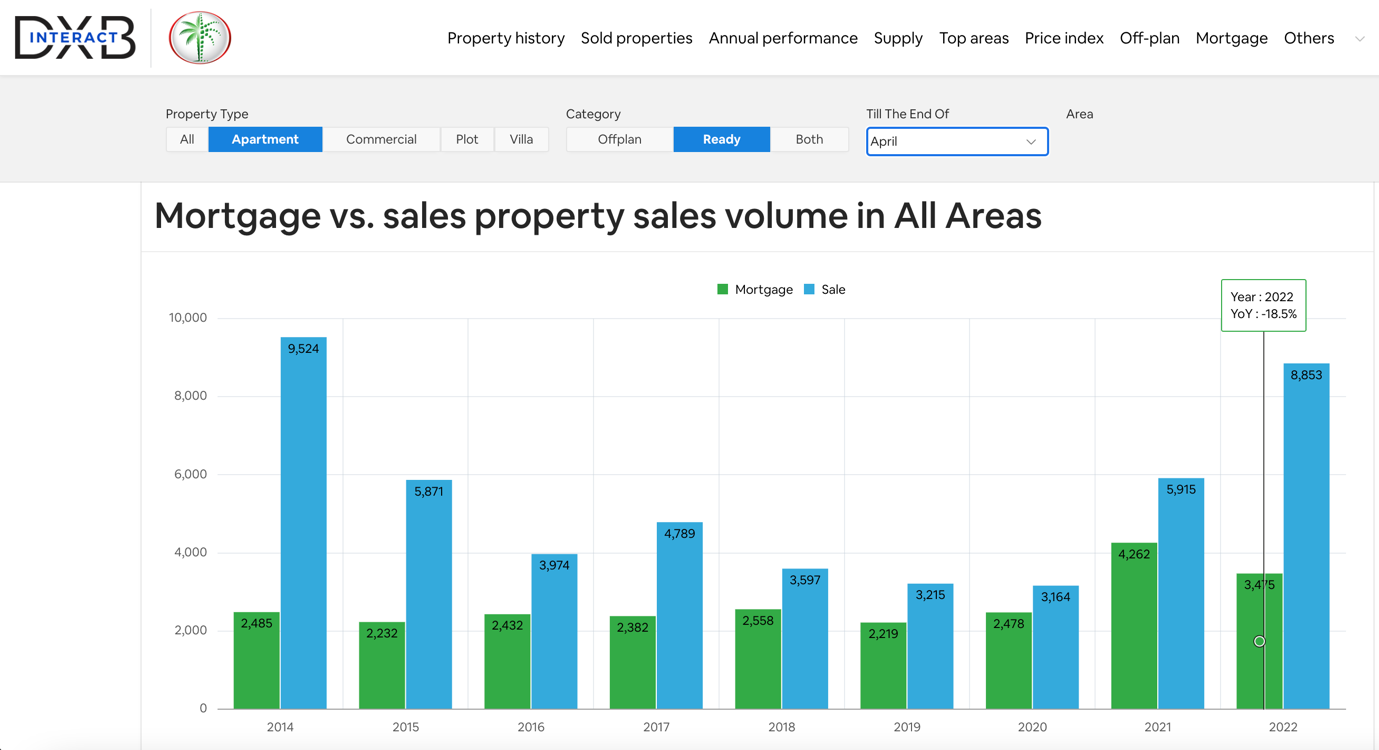

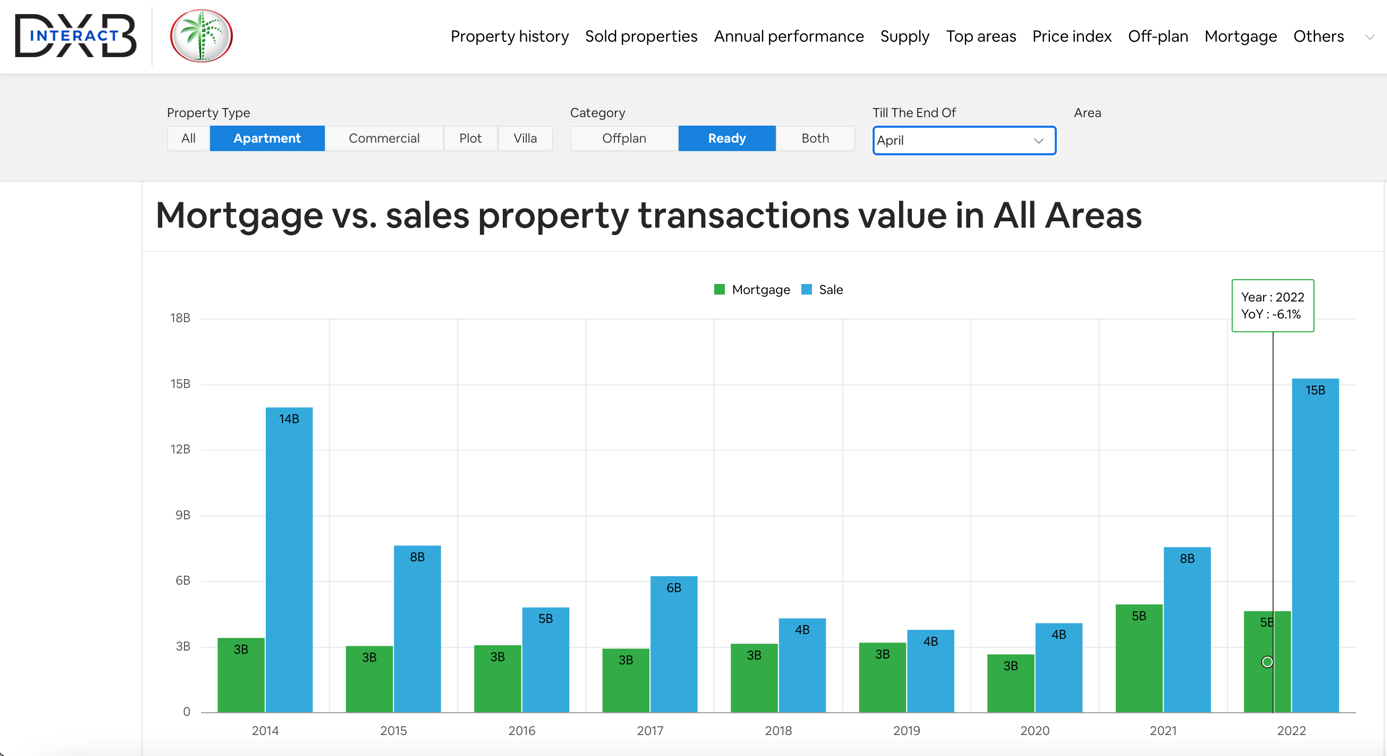

- Most recently Q1 2022 have witnessed an overall drop of mortgage transactions by 27% amounting to 5387 transactions and 35.5% drop in value of mortgage transactions amounting to 25.1 billion. According to www.DXBinteract.com Q1 2022 real estate market report.

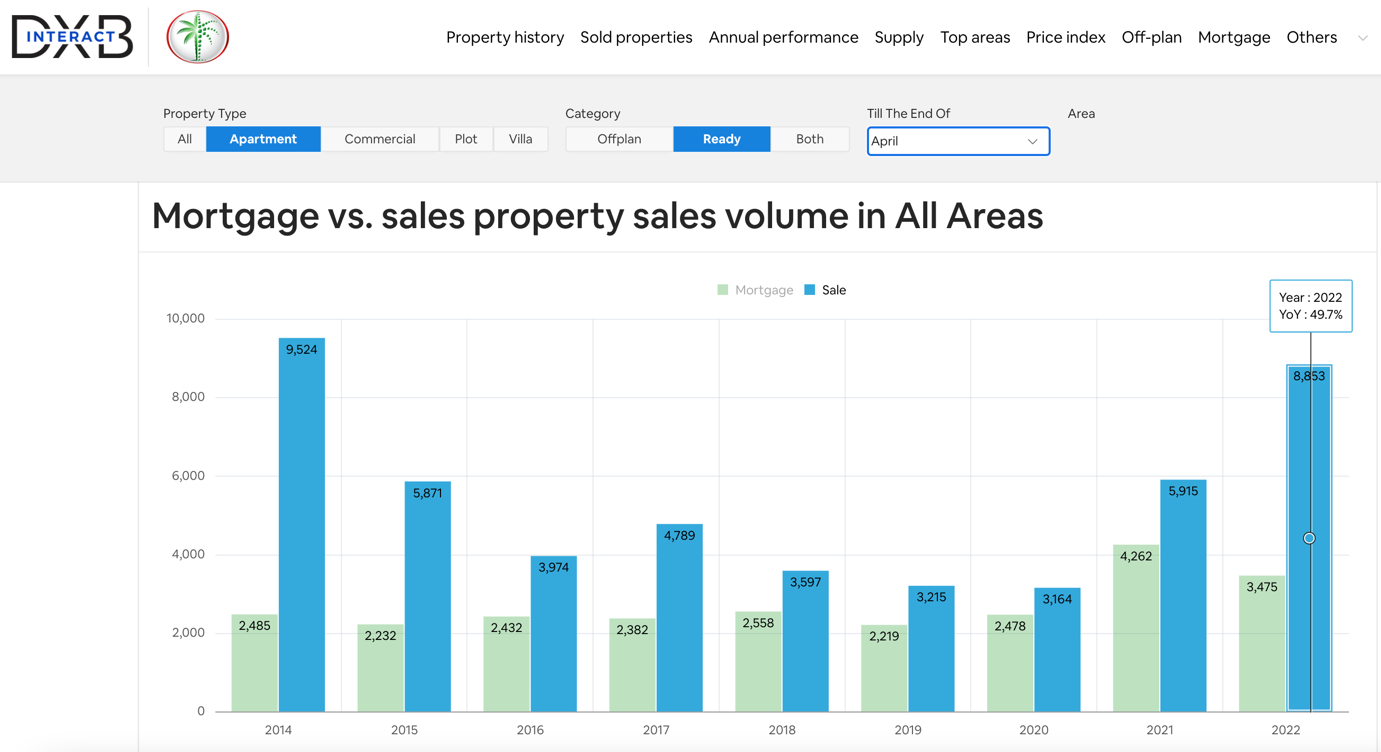

Taking a deeper look at the mortgage Vs cash buyers for residential apartments during Jan to end April 2022 as compared to Jan to end April 2021, the mortgage buyers (sales transactions) for ready apartment have dropped by 18.5% in number of transactions and 6.1% in value of transactions as compared to Jan to end April 2021. VS the cash-based buyers (sales transactions) have increased by 49.7% in number of transactions and 101.9% in value of transactions as compared to Jan to end April 2021. Reference www.DXBinteract.com

- Dubai average housing price are considered undervalued not just as compared to other global cities, but also as compared to its historical prices. With the exception of the niche of ultra-luxury property prices that were highly simulated post covid, 2022 prices stand more or less at 2014 price point. Unlike the US housing market that went more than double since 2009 global crisis according to FRED Economic Date.

What is the risk on the housing market?

As mentioned above, the Fed seems to continue upwards with fighting inflation, however, so far we have not seen any major price softening in US or EU. But Dubai remains an integral part of the global economy and although it will have more resilience than other global cities, Dubai is not immune to any possible economic global impact. So I don’t see any major micro risk, it is more about the global economic risk which the entire world is subject to.

Five fundamental factors behind healthy housing market in Dubai

- Dubai housing prices today are beyond reasonable when you look at both the global scale as well as the historical housing prices for the last 10 years. Which creates a clear opportunity to enter the market.

- Despite prices recovering post the pandemic to more or less 2014 prices, yet the hard and the soft infrastructure in Dubai has improved by 10 X when compared to the last 10 years. This makes today’s housing prices even more attractive than any other global city.

- Growing population, the population rose by nearly 100,000 during the last 2 years surpassing 3.5 million in 2022 which is a major pillar for the growing demand in the housing market.

- Very strong upward demand from all over EU in Dubai real estate market as they see it well priced offering plenty of capital gain opportunities on the short and medium level.

- A shift in developers’ mindset, post covid Dubai real estate developers are focusing more than ever before on the living experience elements in their projects. Unlike the past where most of the project’s supply appeared to have too many similarities.