Key Takeaways

- Dubai’s real estate market has become increasingly independent of oil price fluctuations, especially after 2014.

- Recent data shows no strong correlation between oil prices and property sales or investor activity.

- Investor confidence, foreign capital, and government reforms are now bigger drivers of market growth.

- Long-term visas, remote work policies, and full foreign ownership have boosted real estate stability.

- Demand is becoming more globally diversified, with buyers coming from Europe, Asia, and beyond.

- Dubai’s property market is now shaped more by structural reforms and global trends than by regional oil revenue.

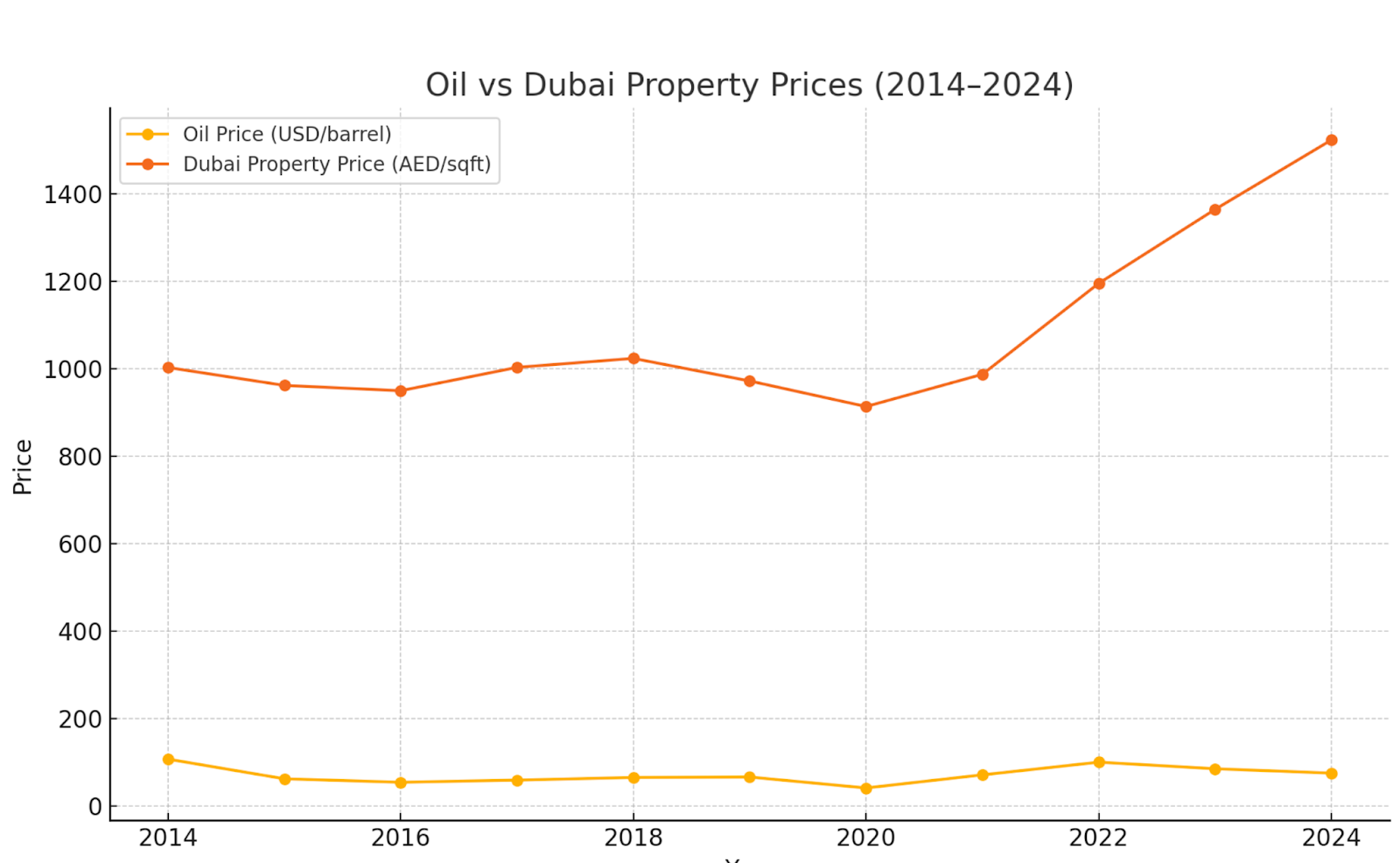

For decades, analysts assumed Dubai’s real estate market rose and fell with oil prices. But is that still true in 2025? We dug into 10 years of real data—comparing Brent crude oil prices with Dubai property price trends—and the results may surprise you.

What We Analyzed

We looked at average oil prices from 2014 to 2024 and matched them against Dubai’s average property prices per square foot. Initially, a moderate correlation (r = 0.43) appeared—suggesting some link.

But here's the catch: that correlation is distorted by two major global shocks.

Two Global Events Skewed the Data

1. The Post-COVID Boom (2021)

After global lockdowns, pent-up demand, remote work trends, and wealth migration fueled a sharp rebound in Dubai real estate—regardless of oil.

2. Russia-Ukraine War (2022)

Oil prices surged due to sanctions and supply shocks, not demand. At the same time, Dubai saw a flood of capital inflows from Russian, European, and global investors seeking geopolitical stability.

Important note: The apparent oil-property correlation during 2021–2022 is more accurately explained by a synchronized global recovery—not causation.

Why Everything Correlates During a Crisis

During global crises, investors often adopt a “risk-on / risk-off” mindset—leading to temporary correlations across unrelated assets.

So, while oil and real estate appeared to move together, the real driver was global liquidity, low interest rates, and a flight to safety—not oil fundamentals.

We Reran the Numbers Without 2021 & 2022

Once we removed these distorted years from the data:

- The correlation dropped to r = 0.40

- The result was statistically insignificant (p = 0.28)

In plain terms: there's no reliable link between oil prices and Dubai property values today.

What Really Drives Dubai Real Estate Now?

- Wealth migration from Europe, Asia, and CIS countries

- Pro-investor government reforms (Golden Visa, 0% tax)

- Luxury lifestyle appeal and global safe-haven positioning

- Mega-projects in tourism, hospitality, and innovation sectors

Dubai has diversified far beyond oil—and so has its real estate market.

Bottom Line

Oil no longer drives Dubai property prices.

In today’s market, prices are shaped by global capital flows, migration patterns, and investor sentiment—not barrels of Brent crude.

Ready to Invest Smarter?

At fäm Properties, our insights are powered by real-time data, not outdated narratives.

Explore the latest market trends at dxbinteract.com, or speak to a property advisor who actually understands the market.