Executive Summary

Dubai has transcended its role as a regional player — it is now a global magnet for capital. In 2025, the emirate is not just seeing investor interest — it's absorbing it. As geopolitical uncertainty, inflation risks, and over-regulated markets drive wealth out of traditional cities, Dubai is emerging as the go-to destination for security, yield, and lifestyle.

This article breaks down why capital — from private offices to HNWIs — is pouring into Dubai real estate, with DXBinteract market data, regional performance benchmarks, and strategic positioning.

A Global Repositioning of Wealth

Traditional markets like London, New York, and Hong Kong are under increasing pressure from rising taxes, tightening regulations, and unpredictable political environments.

Enter Dubai:

- 0% capital gains tax

- Stable AED/USD peg

- World-class infrastructure

- 10-year Golden Visa for real estate investors (min AED 2M)

- Unmatched lifestyle for international families

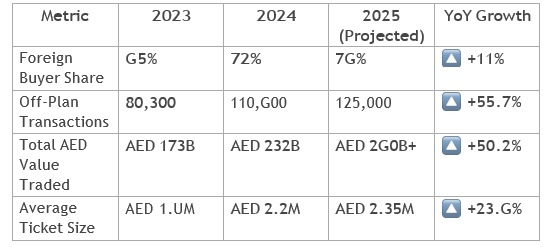

Capital Inflow Trends – DXBinteract 2023–2025

Insight: Off-plan dominance is growing, and HNW capital inflows are now clearly driving Dubai’s residential strategy — especially in the luxury and investment-grade mid-market segments.

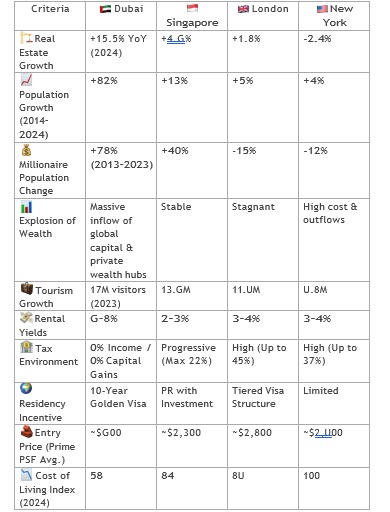

Dubai vs. Global Cities: Strategic Advantages

Conclusion:

Dubai not only leads in real estate growth, population expansion, and investment inflow, but it also offers the most competitive tax, residency, and lifestyle incentives. This makes it the most strategically positioned global city for HNWIs, private offices, and global investors in 2025

and beyond.

now amplified by the 10-year Golden Visa and modern residency pathways.

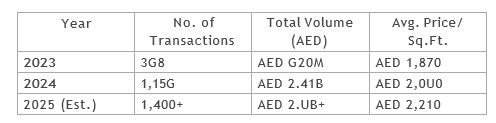

Investment Hotspot: Bukadra Case Study

One of Dubai’s fastest-emerging zones, Bukadra, is a perfect case study of smart capital at work:

Bukadra Off-Plan Market Performance Summary (DXBinteract)

Transaction Growth (2023–2024): +214%

Volume Growth: +289%

High-end launches in Bukadra (e.g., AYAAN, Sobha, Claydon House) are redefining price bands, product design, and community amenities — targeting both yield investors and end-users.

Key Insight: Despite this surge, Bukadra prices remain 15–20% lower than MBR City and Dubai Hills, making it one of the most undervalued waterfront zones today.

Strategic Takeaway for Investors

- Smart Capital Is Early Capital: The strongest returns in Dubai over the past decade were captured by early buyers in Marina, Business Bay, and Downtown — Bukadra is now in that early phase.

- Golden Visa Boost: Projects in this zone start from AED 2M — hitting the sweet spot for Golden Visa access with capital preservation.

- Yield + Lifestyle = End-User Magnet: Investors today are choosing areas that also work for living, not just leasing — and Bukadra’s park & lagoon mix hits that mark.

Final Thought

In 2025, Dubai is no longer a “promising” market — it’s a proven global investment hub.

With more flexible visa programs, robust developer competition, and infrastructure catch-up zones like Bukadra, the global shift in real estate wealth is already underway.

Smart capital is moving fast — are you?