Key Takeaways

-

Dubai’s residential prices rose 16–18% YoY, with further growth expected through 2025, making it one of the fastest-growing luxury markets globally.

-

Despite new supply, Dubai remains far cheaper than Monaco or New York, offering prime properties at ~$850 per sq ft vs. over $5,000 per sq ft in Monaco.

-

Abu Dhabi, Singapore, and Paris show modest or flat growth, while Hong Kong and London face mild corrections.

-

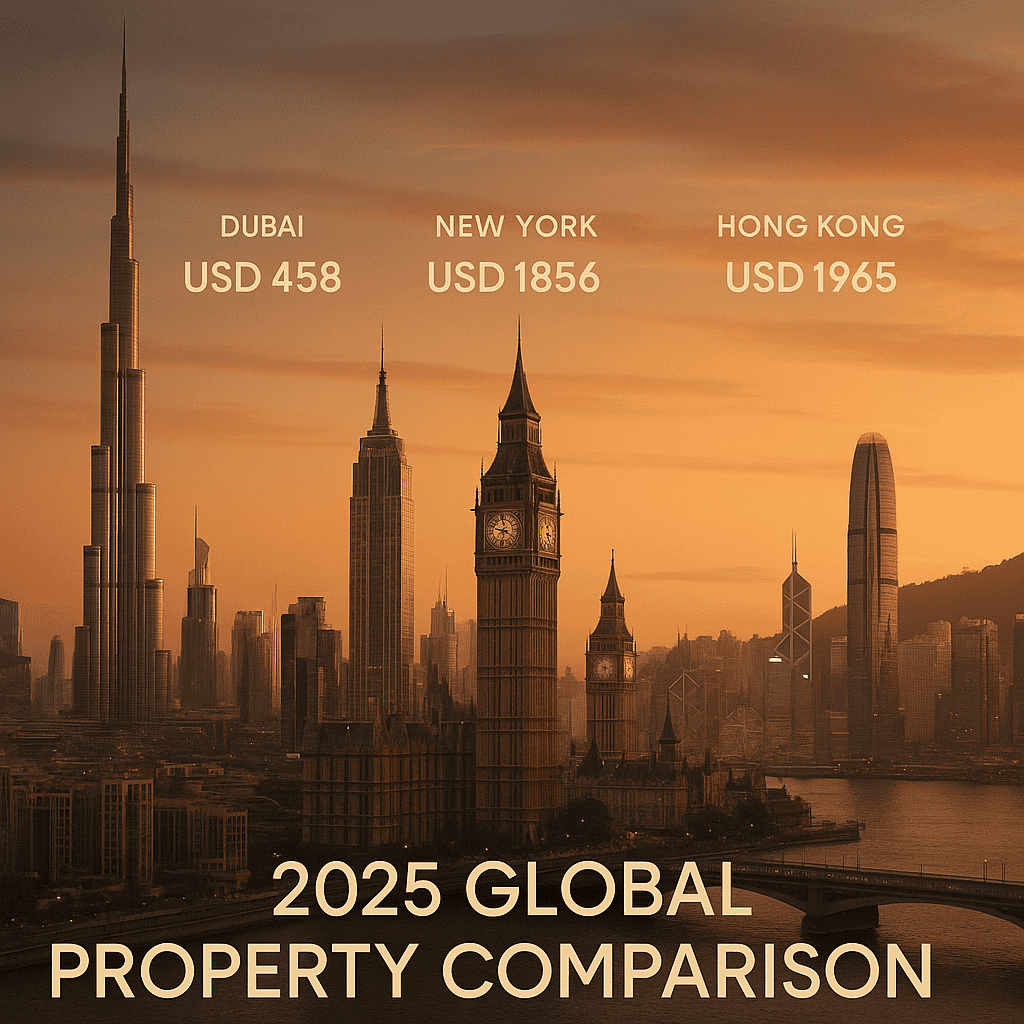

Global price leaders in July 2025 include Monaco ($5,300/sq ft), New York ($1,856/sq ft), and Hong Kong ($1,965/sq ft) – Dubai remains undervalued by comparison.

-

High rental yields and Golden Visa initiatives continue to boost Dubai’s appeal to international investors.

Dubai Real Estate – A Market Outperforming Global Giants

Dubai’s residential market is in a league of its own, registering average prices of $458 per sq ft (AED 1,582) as of July 2025 – up 16–18% year-on-year. This exceptional growth is driven by foreign investor demand, record transaction volumes, and pro-investor policies, including Golden Visa incentives and zero property tax.

Despite new supply – with more than 20,000 new units delivered in H1 2025 – Dubai’s market has remained bullish. Luxury homes, especially in Palm Jumeirah, Downtown, and Dubai Hills, are setting new price benchmarks. Market analysts, including Betterhomes and ValuStrat, predict further appreciation of 5–10% through the rest of 2025.

Compared globally, Dubai still offers incredible value. Prime properties cost roughly $850 per sq ft, far less than prime markets like Monaco ($5,300), New York ($1,856), or London’s prime zones (~$2,700). This pricing gap, coupled with high rental yields (6–8%), makes Dubai a top choice for investors seeking both capital appreciation and income.

Global Comparison: Dubai vs. Other Key Cities

Monaco continues to hold its crown as the world’s most expensive property market, with prices topping $5,300 per sq ft. Yet, growth is limited (just +1% YoY) due to ultra-low supply.

New York (Manhattan) averages $1,856 per sq ft, up a modest 2–3% YoY, while Hong Kong prices are down 7–8% YoY due to prolonged market corrections, despite still commanding nearly $1,965 per sq ft.

In Europe, London is showing a slight decline (around –2% YoY) as interest rates impact affordability, whereas Paris and Amsterdam are stabilizing with prices around $910 and $854 per sq ft, respectively.

Global Residential Price Comparison – July 2025

| City |

Avg. Price (USD/sq ft) |

YoY Change |

2025 Forecast |

Key Insight |

| Dubai |

$458 |

+16–18% |

↑ +5–10% |

Strong investor demand, tax-free, Golden Visa driver |

| Abu Dhabi |

$259 |

+7% |

↑ Modest |

Limited supply, villa segment leads growth |

| Amsterdam |

$854 |

+0.7% |

↑ Slight |

Price growth capped by EU rate impact |

| Paris |

$910 |

–3% |

↑ Return to growth |

Recovery expected after mild correction |

| London |

$950 |

–2% |

↓ Slight |

Higher taxes & rates cooling demand |

| Singapore |

$1,593 |

0% (Flat) |

Flat / ↓ Slight |

Cooling measures limit price growth |

| New York |

$1,856 |

+2–3% |

Flat |

Resilient, but high rates cap growth |

| Hong Kong |

$1,965 |

–7–8% |

Stabilizing |

Market bottoming out after 3 years of declines |

| Geneva |

$2,800 |

+2% |

↑ Gradual |

Safe-haven, steady luxury demand |

| Sydney |

$2,066 |

+8–9% |

↑ +5% |

High demand, limited luxury supply |

| Monaco |

$5,300 |

+1% |

↑ Slight |

World's most expensive; ultra-low supply |

Why Dubai Stands Out

-

Tax-Free Advantage: No property taxes and investor-friendly laws attract high-net-worth buyers globally.

-

Golden Visa Program: Investors securing property worth AED 2 million or more receive long-term residency, adding to demand.

-

Affordable Luxury: Dubai offers 3–4 times more prime space for $1 million compared to cities like New York or London.

-

Strong Economic Fundamentals: A rapidly growing population, diversified economy, and major infrastructure projects (e.g., Dubai South, Expo City) keep demand strong.

2025 Forecast

The Dubai property market is expected to remain bullish, especially in prime and luxury segments. Experts forecast an additional 5–10% price growth by the end of 2025, fueled by steady investor inflows, high rental yields, and global capital migration.

By contrast, most global markets are either stabilizing or facing slight corrections due to interest rate pressures and slower economic growth. This disparity positions Dubai as one of the most compelling real estate investment destinations in 2025.