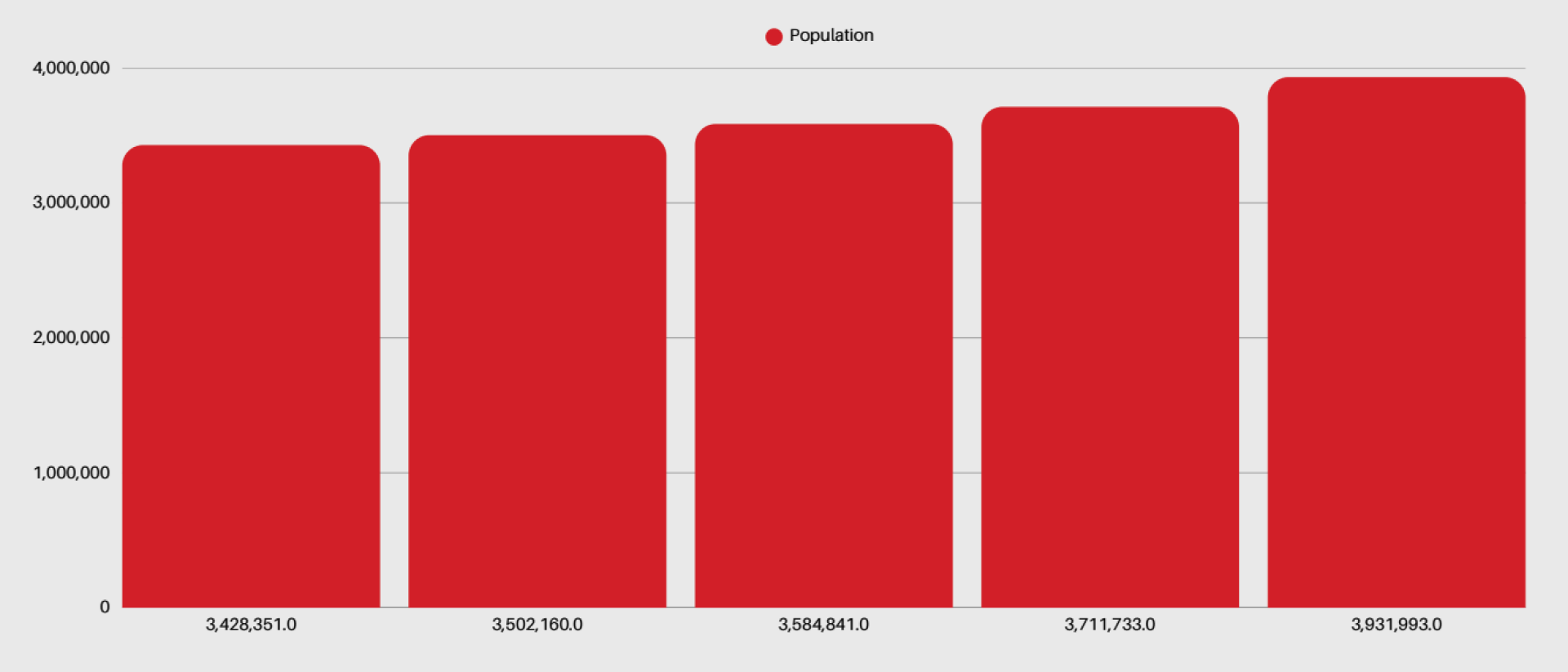

Dubai's real estate market has entered a new era of growth and transformation, spurred by a remarkable surge in population.

In the first quarter of 2025 alone, the emirate welcomed approximately 89,695 new residents, according to data from ValuStrat. That equates to nearly 1,000 people relocating to Dubai every day. This accelerated demographic expansion has placed immense pressure on the housing market, driving up demand for both rental and for-sale properties across nearly all asset classes. The result has been a robust and broad-based appreciation in capital values and rental rates, with certain communities emerging as clear beneficiaries of this heightened demand.

For industry players and stakeholders, Q1 2025 marks a pivotal moment that reinforces Dubai’s position as one of the most dynamic and desirable real estate destinations globally.

Population Growth and Housing Demand

While Dubai's allure as a global business and lifestyle hub has always attracted international residents, the current population spike is on an entirely new scale. The sharp influx of nearly 90,000 new residents in just three months has placed unprecedented strain on the city’s housing inventory. Compounding this issue is the fact that housing supply has lagged considerably.

In 2024, only 27,000 new residential units were completed—the lowest figure in six years—fulfilling just 58% of projected supply needs. This mismatch between supply and demand has created a highly competitive environment, where available properties, particularly those in premium or well-located communities, are snapped up quickly by buyers and tenants alike. Developers are racing to launch new projects, but with construction lead times and regulatory hurdles, it is unlikely that the supply gap will be closed in the short term. This sustained imbalance has set the stage for strong upward pressure on prices and rents throughout 2025.

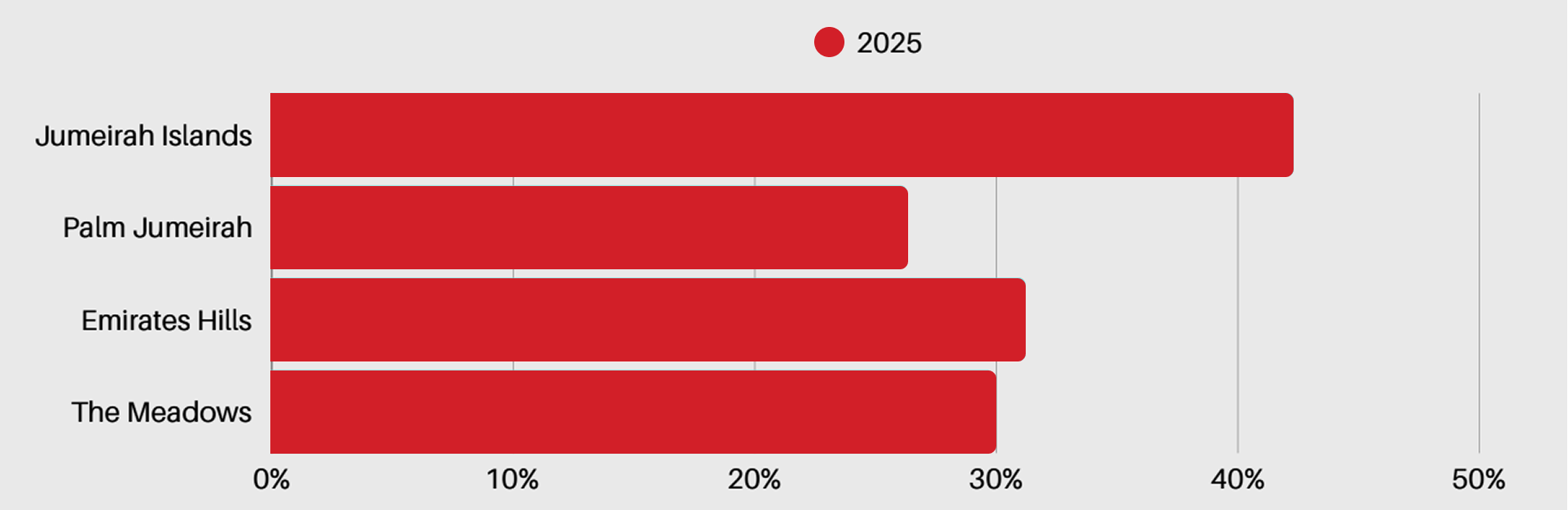

Capital Value Increases Across Key Communities

Nowhere is the impact of demand-driven growth more visible than in the capital value appreciation observed in Dubai’s high-end villa communities.

In Q1 2025, Jumeirah Islands led the charge with a staggering year-on-year capital value increase of 42.3%. This surge underscores the growing demand for upscale, low-density residential environments that offer a sense of community, privacy, and access to nature while remaining close to central Dubai.

Emirates Hills followed closely with a 31.2% gain, maintaining its status as Dubai’s premier address for ultra-high-net-worth individuals seeking exclusivity and architectural distinction.

The iconic Palm Jumeirah experienced a 26.3% increase, reinforcing its appeal as a global luxury destination offering waterfront living and proximity to five-star amenities.

Meanwhile, The Meadows recorded a 29.9% gain, reflecting sustained interest in mature, master-planned villa communities that deliver lifestyle and value in equal measure.

These capital value increases are not speculative in nature; they are grounded in genuine end-user demand and supported by demographic and economic fundamentals.

Additionally, they reflect Dubai’s post-pandemic lifestyle shift, where quality of life, open space, and privacy are prioritized more than ever before.

Rental Market Trends

Rental values across Dubai have also experienced strong upward momentum in response to population growth and constrained supply.

| VILLA RENTS |

APARTMENT RENTS |

| Increased by 5.8% annually |

Surged by 13% annually |

Villa rents have increased by 5.8% year-on-year, continuing a steady climb that began post-COVID. More strikingly, apartment rents have surged by 13%, a reflection of returning demand in key urban centers.

This divergence points to a layered market, where villas attract families and long-term residents seeking spacious accommodations, while apartments cater to professionals, new expatriates, and younger tenants seeking affordability and convenience.

Areas such as Downtown Dubai, Dubai Marina, Business Bay, and Jumeirah Village Circle have seen substantial rental increases as demand outpaces supply.

With rental yields remaining attractive in these neighborhoods, investors are increasingly targeting rental properties as part of their portfolio strategy. Additionally, the steep rise in rents is pushing many long-term tenants to consider transitioning into homeownership, thereby contributing to heightened activity in both the off-plan and secondary markets. If supply bottlenecks persist, the issue of rental affordability may become a central concern for policymakers and developers in the near future.

Off-Plan and Secondary Market Dynamics

The off-plan segment has emerged as the dominant force in Dubai’s residential real estate landscape, accounting for 70.8% of all home sales in February 2025.

Several factors underpin this trend: favorable payment plans, lower entry costs, and the perception of higher appreciation potential in emerging areas.

According to ValuStrat, Oqood registrations—a key indicator of off-plan activity—rose by 22.2% month-on-month and 59.5% year-on-year in February, reflecting robust investor and end-user interest.

| Off-Plan Sales |

Oqood Registrations |

| Accounted for 70.8% of all home sales in February |

Increased by 22.2% monthly / 59.5% annually in February 2025 |

Developers have responded with a wave of new launches across locations like Dubai South, Arjan, and Mohammed Bin Rashid City (MBR City), offering a spectrum of units from affordable studios to luxury townhouses. Simultaneously, the secondary market remains active, with 12,396 ready-home transactions recorded in Q1 2025, up 5.8% from the same period in 2024.

This shows a healthy appetite among buyers seeking immediate occupancy, established neighborhoods, and proven rental income. What’s particularly encouraging is the balanced strength across both segments, indicating a well-rounded and maturing market.

Buyers today are more informed, strategic, and diverse—ranging from first-time homeowners and expatriate professionals to seasoned investors seeking capital growth and passive income.

fäm Properties: Navigating the Market Surge

At fäm Properties, we have not only observed these changes but actively shaped our strategies to help clients navigate this evolving market. With specialized focus on Dubai’s top-performing communities such as Jumeirah Islands, Emirates Hills, Palm Jumeirah, and The Meadows, our team has consistently delivered insights, value, and results.

Our success is driven by a combination of data analytics, local expertise, and a strong network of developers, investors, and partners.

- For sellers, we leverage targeted marketing campaigns to attract qualified buyers, often resulting in swift transactions at premium prices.

- For buyers, we offer a 360-degree advisory approach that includes financial planning, property selection, yield analysis, and resale strategy.

- In the off-plan space, our longstanding relationships with developers enable early access to top-tier projects—a key advantage in today’s competitive environment.

Additionally, our in-house mortgage consultants, legal advisors, and investment strategists provide a seamless and comprehensive service experience, making us a trusted partner for all types of clients, from first-time buyers to institutional investors.

In a market defined by speed, precision, and opportunity, fäm Properties remains a steadfast ally for those looking to build wealth through real estate.

Strategic Investment Opportunities

Q1 2025 has ushered in a unique window of opportunity in Dubai’s real estate market. The alignment of population growth, constrained housing supply, and rising rents has created a fertile environment for strategic investment.

Capital appreciation in prime villa communities, robust off-plan demand, and rising rental yields signal strong confidence in the market’s fundamentals.

For investors, this is a time to act decisively, targeting communities with proven growth, limited future supply, and strong lifestyle appeal.

For end-users, buying now could mean securing long-term value before prices escalate further. Off-plan properties continue to offer compelling opportunities, especially when vetted for developer credibility, location advantages, and realistic completion timelines.

As always, the key to successful investment lies in access to accurate data, expert guidance, and a well-informed strategy. At fäm Properties, we are committed to empowering our clients with all three. With Dubai poised for continued economic and demographic expansion, real estate remains one of the most secure and rewarding avenues for wealth creation and lifestyle enhancement in the region. Contact Us Today!