Dubai’s property market has spent the last few years in the headlines — spectacular gains, an influx of international buyers, and a development pipeline that promises to reshape the city’s housing stock. Lately, however, the tone has shifted: global analysts now flag bubble risk and potential correction, while local fundamentals still signal resilience. Which view is right? The truth may be that the market is moving from a pure boom phase toward something more complex — a maturing market with both risks and stabilizers at play.

Global Warnings on Overheating

Three powerful signals have shifted sentiment this year:

-

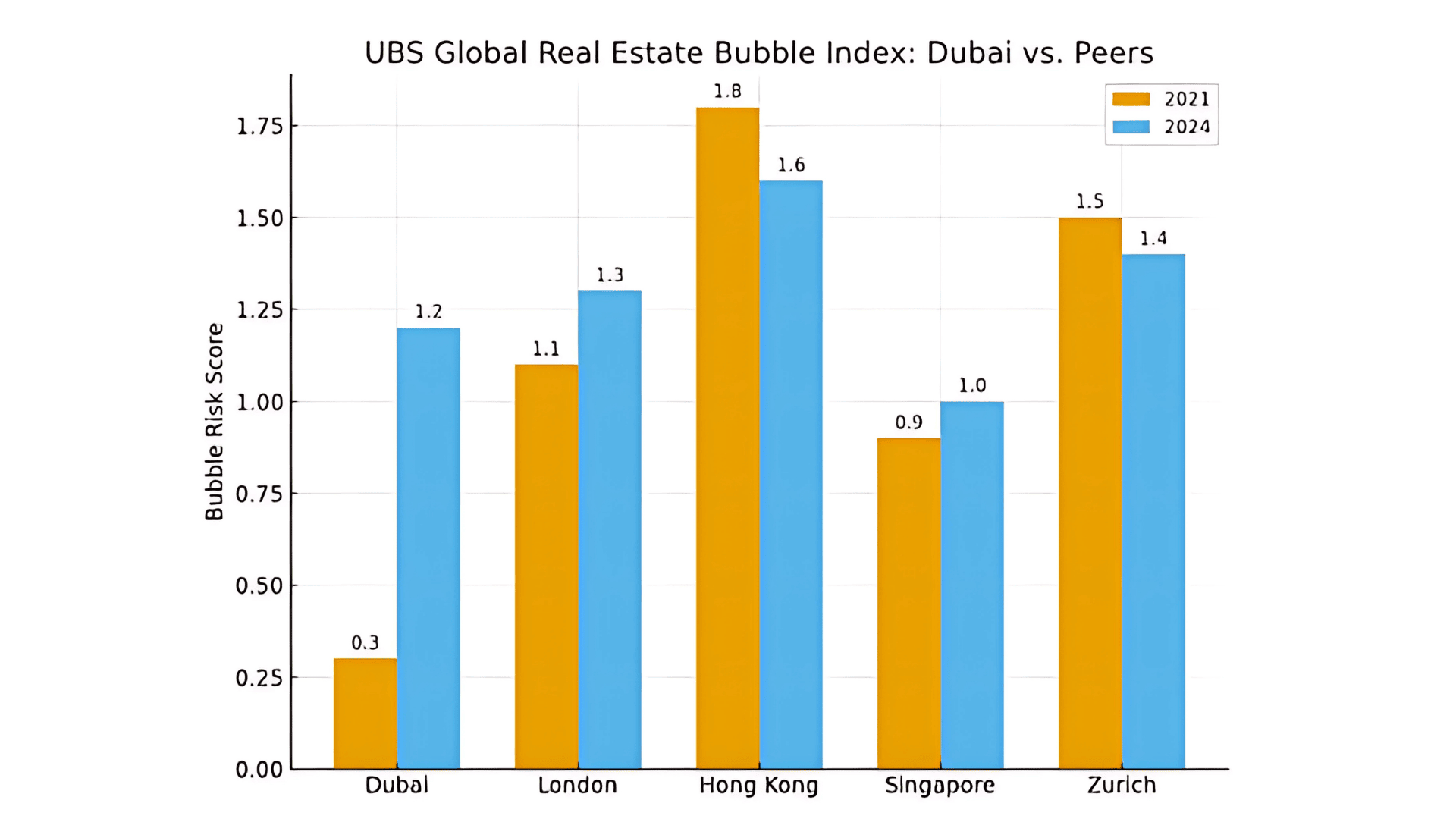

UBS’s Global Real Estate Bubble Index flagged Dubai with elevated bubble risk, noting it showed one of the strongest increases in risk among major cities.

-

Fitch has forecast a potential correction of up to 15% between late 2025 and 2026, citing a surge of new supply.

-

Moody’s and other agencies have echoed concerns that very large housing stock expected in 2026–2027 could pressure prices, particularly in the apartment segment.

These signals matter: they shape capital flows, financing conditions, and global perceptions of Dubai as a real estate destination.

The Counterbalance: Why Resilience Persists

At the same time, local data tells a more nuanced story:

-

Supply is uneven. The bulk of new deliveries are apartments, while villa and townhouse supply remains limited. This imbalance cushions suburban family housing against the full force of correction pressures.

-

End-user demand is strong. Much of the recent activity in townhouses and villas has been driven by families buying to live, rather than speculators. This type of demand is more stable and less sensitive to short-term cycles.

-

Policy buffers are stronger. Dubai’s escrow rules, tighter financing standards, and more disciplined banking exposure mean the system is less vulnerable to speculative overheating than it was during the 2008 crisis.

-

Macro tailwinds remain. Population growth, high-net-worth migration, and relative affordability compared to global peers continue to provide underlying demand, even as global rate shifts introduce some volatility.

A Market of Micro-Trends

Perhaps the most important shift is that Dubai should no longer be viewed as a single, uniform property market. Instead, it is a collection of sub-markets moving at different speeds:

-

High-density apartments in oversupplied areas may face price pressure and slower absorption.

-

Villas and townhouses in well-planned communities remain resilient, underpinned by lifestyle appeal and limited supply.

-

Prime luxury segments with constrained new delivery — such as Palm Jumeirah and Dubai Hills — are likely to continue attracting global wealth despite broader moderation.

Conclusion: From Boom to Balance

The last three years have been defined by surging prices and record demand. The next phase may be defined by segmentation and stabilization.

Global agencies are right to highlight risks — and a degree of correction in certain parts of the market is plausible. But equally, the structural dynamics of Dubai’s economy, demographics, and policy frameworks suggest a more mature trajectory: moderation, definitely not a meltdown.

Stay ahead of Dubai’s evolving market — explore data-driven insights and expert guidance with fäm Properties.

Join our Telegram for live updates and off-market insights.