The Dubai Property Market in 2021 featured three main trends:

- Surging demand for luxury apartments

- A massive increase in villa sales

- Steep hike in rental prices across the city

The real estate market hit new all-time high records:

1 - The most significant sales value ever of over AED 150B.

2 - The highest sales volume since 2013 with over 60,500 properties.

3 - The best year ever for the off-plan property sales volume of 25,000 properties.

4 - The highest villa sales volume ever with 7,580 off-plan and 6,000 ready villas.

5 - The highest apartments sales volume since 2013 of 39,570 apartments.

6 - Over 35,000 properties were delivered.

7- Over 21,500 properties were launched.

8- Over 55,000 properties are scheduled for delivery in 2022. However, practically, over 40,000 properties have exceeded 60% of construction progress and are expected to be delivered in 2022.

So, the Dubai real estate market got back on its feet and performed well beyond expectations. The total sales exceeded 60,900 properties. This is up a whopping 75% from the year 2020; whereas, the sale value surged by 110% to AED 150 billion. This outstanding performance is pushed by five main factors:

- The extraordinary precautionary procedures that were taken by the government to face Covid-19.

- The massive increase in the salesforce in the market where the number of agents increased by 57% and exceeded 7,500 agents working for over 1,800 agencies.

- The government’s economic stimulus packages.

- The Expo 2020.

- The huge demand for luxury properties where the sales volume of apartments worth more than 10,000,000 AED increased by 235% vs. 2021 and 115% vs. 2013.

The breakdown of the property sale volume by category:

- 39,570 Apartments (+63.4% vs. 2020)

- 13,653 Villas (+112% vs. 2020)

- 2,361 Commercial (+102.3% vs. 2020)

- 5,374 Plots (+81.1% vs. 2020)

How property prices increased in 2021

Property median prices:

Median prices per sq.ft:

Off-plan vs. Ready Transactions

2021 records 25,280 off-plan transactions making an increase of 51% vs. 2020; whereas, ready property transactions increased by 92% vs. 2020 to 36,400 transactions.

Apartments:

- 48 percent of the apartment transactions were off-plan, and 52 percent were ready, while the sales value was 54% (AED 35.1B) off-plan vs. 46% (AED 30.5B) ready.

Villas

- The sales value was 32% (AED 12.9B) off-plan vs. 68% (AED 27.2B) ready.

- while the sales volume was 44% off-plan and 56% ready villas.

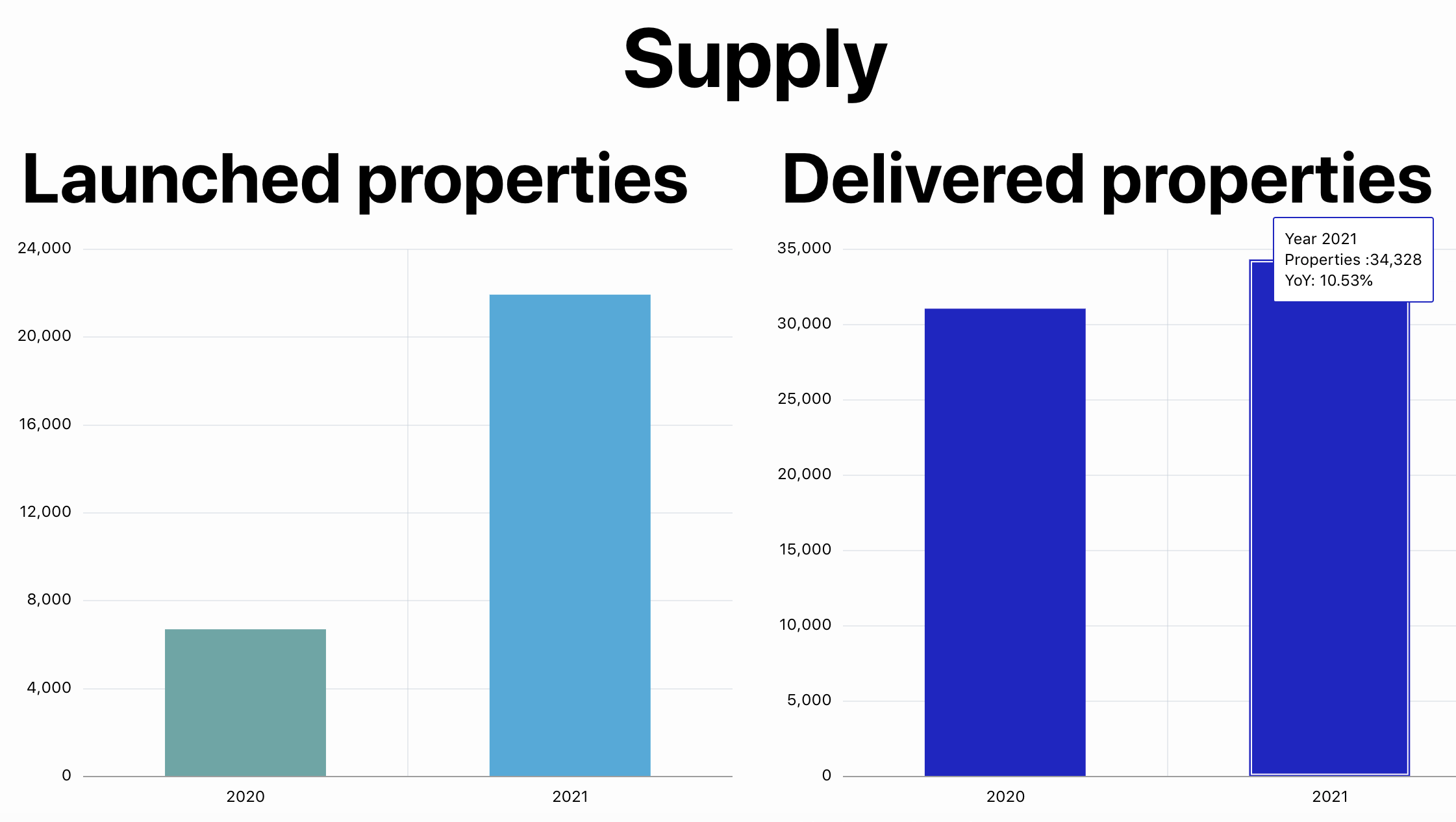

Supply:

Over 35,000 units were delivered in 2021. Emaar had the lion-share of 20%, 16% by Damac, and 4% by Dubai Properties. 55% of the scheduled units to be delivered in 2021 have been postponed. The delivery concentered on the following areas:

- MBR City, 13,447 (11%)

- Business Bay, 12,458 units (11%)

- Marina, 7,214 units (6%)

- Damac Hills, 7,210 units (6%)

- Downtown, 5,908 (5%)

Compared to 2020, the launched units increased by 69.83% to over 21,700 units composing 103 projects.

The areas with the most launched properties are:

- Mohammad Bin Rashid Al Maktoum City 3,626 units (17.06%)

- Damac Hills Dubai 3,377 units (15.89%)

- Business Bay 1,898 units (8.93%)

- Jumeirah Village Circle 1,535 units (7.22%)

- Dubai Investment Park 1,174 units (5.52%)

- Al Furjan 1,168 units (5.49%)

Arabian Ranches 1,023 units (4.81%)

Delivery in 2022

Over 55,000 properties are scheduled for delivery in 2022. Practically, over 40,000 properties have exceeded 70% of construction progress and are expected to be delivered in 2022.

Access this interactive report and get a personalized report of Dubai property market