Dubai steps into 2026 following one of the strongest years in its property market history. After a record-breaking Dh 680 billion in transactions, the emirate’s real estate sector is showing signs of maturity, stability, and evolution rather than slowdown. For investors and end users alike, the question is no longer whether Dubai is active — but whether the momentum is sustainable. Current indicators suggest it is.

The market continues to be supported by powerful structural fundamentals. Population growth remains a major driver of housing demand, fueled by long-term residency reforms, global talent inflows, and Dubai’s position as a safe, tax-efficient international hub. At the same time, the buyer base is broader than ever, with strong participation from Europe, Asia, the CIS region, and high-net-worth individuals relocating businesses and families.

By late 2025, total transaction values had already crossed Dh 500 billion across 186,000 sales, surpassing the previous year’s full figures. Luxury homes, apartments, townhouses, and villas all recorded strong performance. Rather than a speculative surge, analysts describe the cycle as demand-led and fundamentally supported, signaling a market that is stabilizing at a higher level.

Technology is also reshaping the landscape. Blockchain-based property tokenization is beginning to enter practical use, gradually changing how assets are bought, sold, and valued. This innovation is expected to improve transparency, accessibility, and liquidity, making Dubai one of the first global cities to integrate real estate with digital asset frameworks at scale.

Despite predictions of a correction, 2026 opened with a historic start. January alone recorded Dh107.96 billion in transactions — nearly double the same month last year — reflecting continued buyer confidence. While selective price cooling may appear in overheated segments, overall capital appreciation trends remain healthy, particularly in well-planned communities with infrastructure, lifestyle amenities, and long-term development vision.

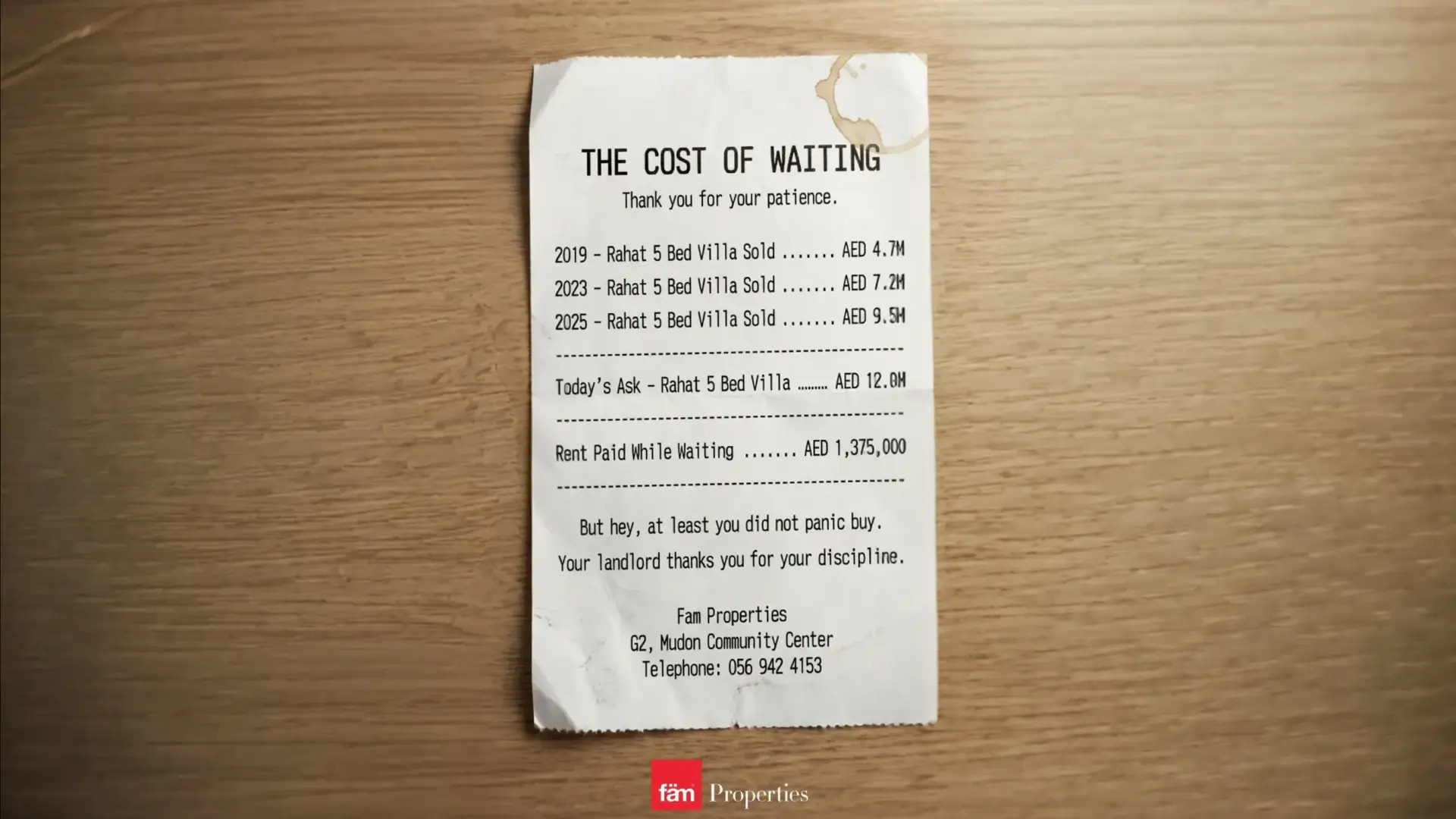

For first-time buyers or those upgrading, the opportunity lies in emerging communities offering larger layouts, better value per square foot, and future growth potential. Strategic selection — not speculation — is the key to long-term gains.

Dubai in 2026 is no longer just a growth story. It is a market defined by scale, global trust, and forward-looking innovation — qualities that continue to make it one of the world’s most compelling property investment destinations.

If you’re aiming to secure a strong, reliable property investment — or simply want to achieve the best possible value for your property — speaking with a true industry expert makes all the difference.

fäm Properties, one of the UAE’s leading real estate companies, has an extensive presence across many prime communities and a team of highly trained, experienced agents who have witnessed the market’s growth firsthand. Their guidance is backed by real transaction data, market insight, and on-the-ground experience — helping you make informed decisions that protect and grow your money.

Don’t rely solely on marketing promises. Trust verified data, proven expertise, and professionals who can clearly show you the numbers behind every opportunity.

Call me today and I promise you a world of opportunities in your property journey, you simply have to sit back and watch your investment grow.

Marian 0569424153

👉 Join our Telegram for verified Dubai real estate insights and live market updates