Fact Takeaways

-

Dubai’s population hit 4M in 2025, growing 6.13% in one year.

-

From 2008–2025, Dubai added 2.4M new residents.

-

Real estate ecosystem: 2,061 developers, 29,353 agents, 8,789 agencies.

-

AI forecasts: 5.1M residents by 2029–2030, requiring requiring 470k–520k new units.

- Next phase = consolidation, not infinite expansion: larger firms and AI-led platforms will dominate.

Dubai has officially crossed a historic milestone: 4 million residents in 2025. From just 1.6 million in 2008 to today’s thriving metropolis, Dubai’s growth story reflects its transformation into a global hub for business, tourism, and real estate. According to official figures, the city added 231,000 new residents in the past year alone, a growth rate of 6.13%, making it one of the fastest-growing urban centers worldwide.

This surge has profound implications — from housing demand and infrastructure expansion to the competitive landscape of Dubai’s booming real estate ecosystem.

Dubai’s Population Growth: 2008–2025

-

2008: 1.6M residents

-

2011: 2.0M residents

-

2016: 2.6M residents

-

2017: 2.88M (+10.36%, biggest single-year jump in recent history)

-

2019: 3.3M residents

-

2021: 3.44M residents (slowed during global pandemic)

-

2025: 4.0M residents (+231K in one year)

Over 17 years, Dubai added 2.4 million people, more than doubling its population. This growth reflects a sustained influx of expatriates, global investors, and talent attracted by Dubai’s tax-free environment, infrastructure, and business-friendly policies.

What’s Driving the Surge?

1. Economic Momentum

Dubai continues to diversify beyond oil — becoming a global hub for trade, finance, technology, logistics, and tourism. The government’s pro-growth policies (Golden Visa, 100% foreign business ownership, free zones) have attracted entrepreneurs and multinationals.

2. Real Estate Magnet

The city’s real estate market mirrors population growth. More residents mean more demand for housing — fueling both off-plan launches and the secondary resale market. With 2,061 developers, 8,789 agencies, and nearly 30,000 agents active in 2025, Dubai’s property sector is among the most competitive in the world.

3. Global Talent Hub

New visa programs have made Dubai more attractive for long-term residents, professionals, and retirees. The inflow of high-net-worth individuals (HNWIs) is particularly reshaping the luxury real estate segment.

Impact on Real Estate Market

Rising Demand for Housing

With 231,000 new residents in 2025 alone, demand for both rental and ownership properties is surging. Developers are responding with mega-projects across Dubai South, Dubai Creek Harbour, and Palm Jebel Ali revival.

Shifting Market Dynamics

-

Mid-market housing remains under pressure due to supply-demand imbalances.

-

Luxury properties are seeing record absorption as global elites choose Dubai for safe-haven investment.

-

Rental yields remain attractive, supported by sustained demand from expatriates.

Infrastructure & Capacity Considerations

Dubai's 2040 Master Plan anticipates this growth, with infrastructure investments in transportation (Metro Blue Line), utilities, and public services scaled to accommodate 5.8 million residents by 2040. However, short-term capacity constraints in schools, healthcare, and utilities may create localized bottlenecks, particularly in rapidly developing areas like Dubai South and JVC.

More Players, More Competition

The Dubai Land Department’s records show:

-

2,061 developers delivering projects across the emirate.

-

29,353 agents competing in an increasingly digital-first marketplace.

-

8,789 registered brokerages, highlighting how fragmented — and competitive — the market has become.

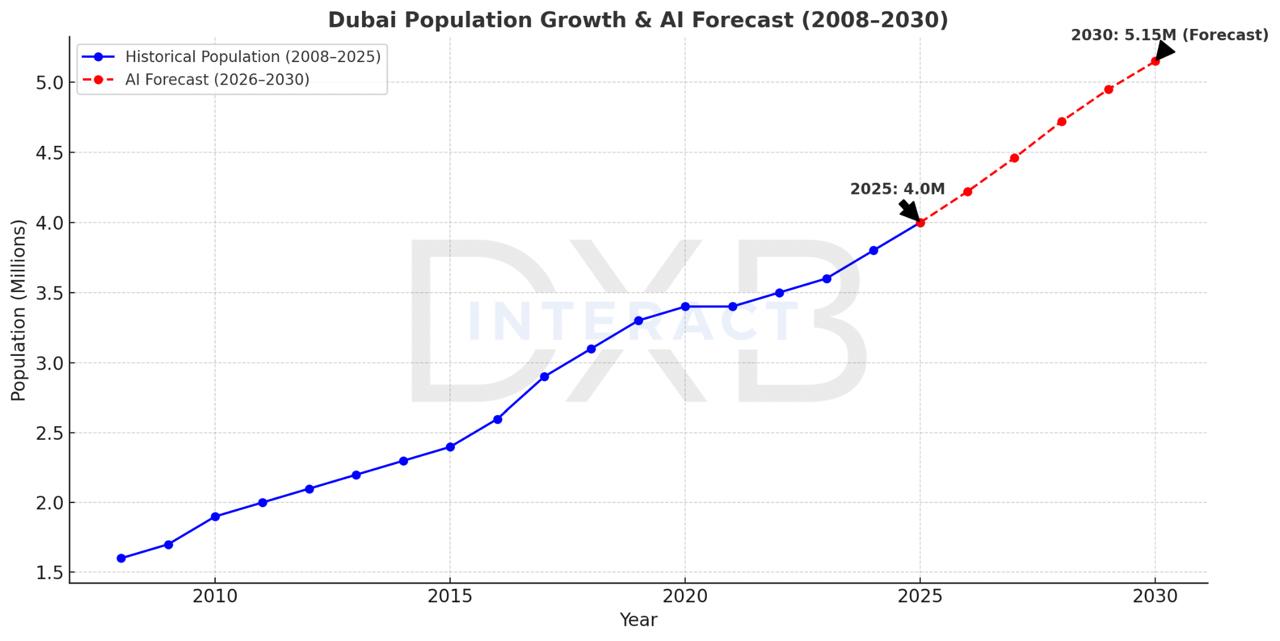

Future Outlook: 2025–2030 (AI-Powered Prediction)

Looking beyond today’s milestone, DXBinteract’s AI-driven models forecast Dubai’s trajectory toward 5 million residents by the end of this decade.

Population Forecast

-

2026: ~4.22M (+5.5%)

-

2027: ~4.46M (+5.7%)

-

2028: ~4.72M (+5.8%)

-

2029: ~4.95M (+4.9%)

-

2030: ~5.15M (+4.0%)

Based on sustained inflows of talent and investors, Dubai could cross 5 million as early as 2029.

Housing Demand

Traditional models assume new population ÷ average household size = units needed. But in Dubai, two factors change the math:

- Investors often buy multiple properties.

- A large share of buyers do not occupy their units (second homes, pure investments).

Housing Demand (Recalibrated)

Dubai's 2025–2030 population gain, when adjusted for multi-property investors, non-resident second homes, a 9% vacancy buffer, and a conservative replacement allowance, points to a need for around 500,000 new housing units by 2030. This is significantly higher than the ~340,000 units implied by household formation alone, highlighting the crucial role of investment-driven demand in shaping Dubai's real estate market.

Luxury Expansion

HNWI migration will keep prime communities (Palm Jumeirah and Jebel Ali, Dubai Hills, Emaar Beachfront) in the global spotlight. Expect continued absorption of ultra-luxury villas and branded residences.

Average 6–7% yields are expected to hold, with emerging communities reaching 8–9%. Rents may stabilize after 2026 as supply increases.

Developers & Agents Growth vs. Saturation

Developers: Could expand from 2,061 to 3,000–3,200 by 2030, but many smaller firms will merge or disappear as barriers to entry rise.

Agents: Headcount may spike beyond 45,000 by 2027, but many will churn. By 2030, expect 35,000–40,000 active agents, with consolidation favoring larger brokerages.

The next phase is not one of infinite expansion, but rather consolidation and professionalization. AI, transparency, and regulation will separate sustainable players from opportunistic ones.

Forecast Methodology & Data Validation

DXBinteract’s AI-driven population projections are built on 17 years of demographic data (2008–2025) combined with:

The model identifies Dubai’s distinctive growth cycles:

2016–2017 Infrastructure Expansion

- Population: The resident base climbed from 2.6M to 2.88M, an annual increase of 10.36%, marking the fastest growth in nearly two decades.

- Real Estate: Sales value rose from AED 105.5B in 2016 to AED 116B in 2017, with off-plan transactions leading the market as developers launched large-scale projects tied to infrastructure growth.

2020–2022 Pandemic Impact

- Population: Growth slowed to around 2–3% per year as mobility restrictions and global uncertainty tempered new arrivals.

- Real Estate: Market activity contracted, with both transaction volumes and values declining. Villas and larger residences remained more resilient as demand shifted toward space and lifestyle.

2023–2025 Recovery Momentum

- Population: Growth rebounded to between 3% and 6% annually, adding more than 600,000 new residents in three years.

- Real Estate: The sector reached record levels of activity, with off-plan sales accounting for over 60% of transactions and total sales value surpassing AED 522B in 2024, reflecting renewed investor confidence and large-scale project launches.

Unlike standard UN demographic models that focus mainly on birth/death rates, our methodology weights migration-driven growth factors such as:

The declining growth trajectory from 5.8% in 2028 to 4.0% by 2030 reflects historical precedent: Dubai’s growth naturally moderates as infrastructure and urban systems reach capacity.

Importantly, the 2030 forecast of 5.15M aligns closely with independent estimates from Dubai Municipality (5.2M) and GMI Research, providing cross-validation across methodologies.

These projections represent our best-case scenario based on current trends, with actual outcomes dependent on global economic conditions, regional competition from Saudi Arabia's NEOM and other mega-projects, and policy continuity in visa programs and economic incentives.

Dubai’s journey from 1.6 million in 2008 to 4 million in 2025 is more than population growth — it’s the story of a city reinventing itself as a magnet for opportunity, capital, and talent.

With AI-powered forecasts pointing to 5 million residents by 2030, Dubai is entering its next phase of growth. For investors, developers, and residents alike, this milestone is not just symbolic — it signals the future evolution of real estate, infrastructure, and lifestyle in one of the world’s fastest-growing cities.

Dubai has arrived at 4 million — but the journey to 5 million has already begun.

Ready to Make the Most of Dubai’s Growth?

Dubai’s population boom is reshaping the city’s real estate market. Whether you’re an investor looking for the next high-yield opportunity or a buyer searching for your ideal property, staying ahead of the curve is key.

Speak to a fäm Properties Advisor today for data-driven insights, off-plan launches, and exclusive opportunities that match your goals.