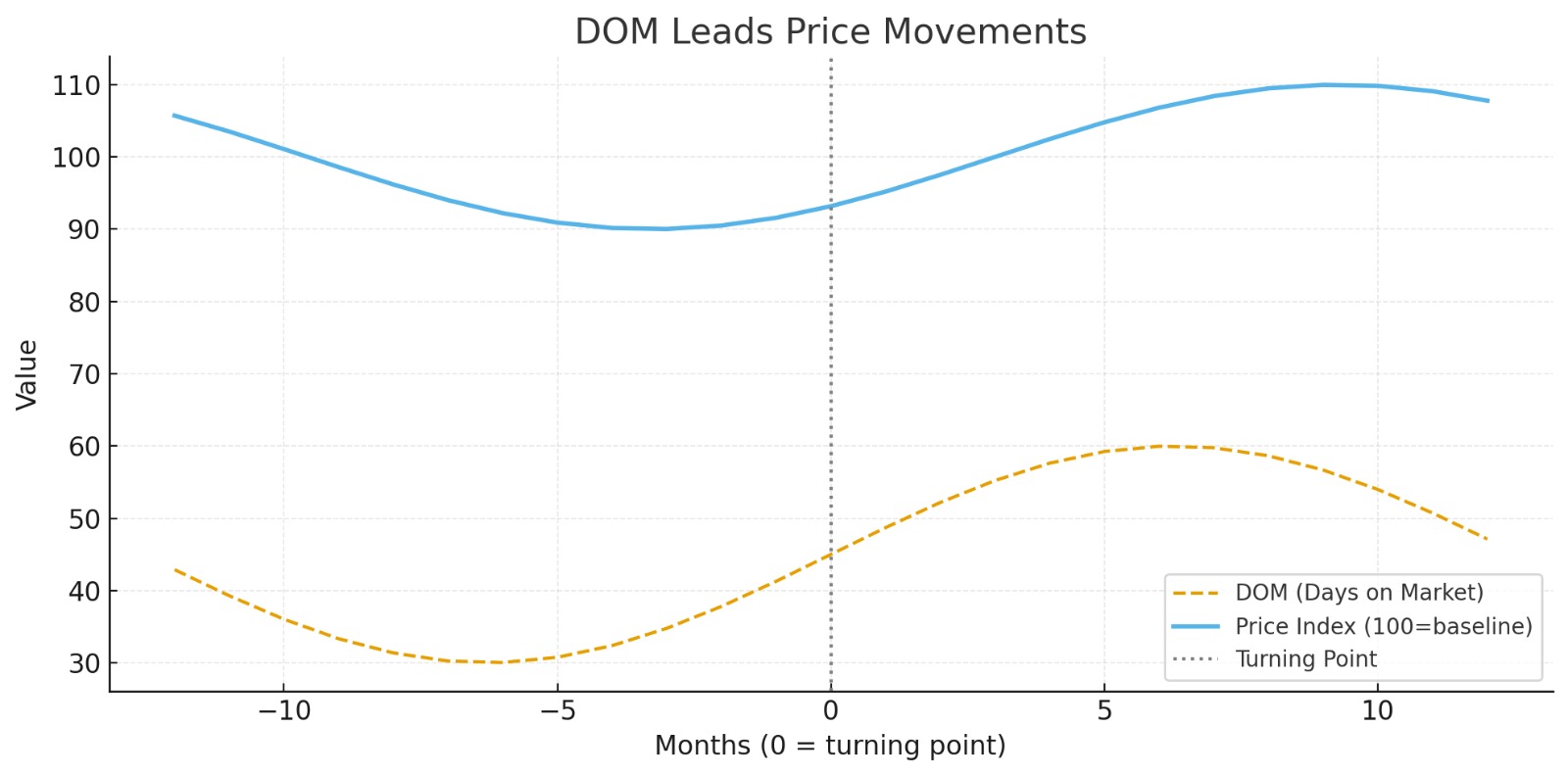

When investors talk about predicting price trends, they often focus on transaction data or listing prices. But professional market watchers know that Days on Market (DOM) — the average time it takes to sell a property — is both a cooling warning signal and a heating confirmation signal. DOM works in both directions, making it one of the most versatile tools for anticipating market shifts.

DOM as a Two-Way Leading Indicator

DOM doesn’t just measure speed of sales — it reflects the balance of power between buyers and sellers:

-

DOM Falling: Market is heating up. Demand is strong, listings move faster, and prices tend to rise soon after.

-

DOM Rising: Market is cooling. Listings linger, buyers gain leverage, and prices tend to soften in the months that follow.

In other words, DOM is like a market thermometer — it warms up before prices climb and cools down before prices fall.

The Chain Reaction: DOM → Listing Prices → Transaction Prices

DOM moves before price changes appear in the data. The dynamics work like this:

-

DOM Changes – either compresses (heating market) or stretches (cooling market)

-

Listing Price Behavior Follows – sellers raise asking prices in hot markets, cut them in slow markets

-

Transaction Prices React Last – official deal data eventually reflects the new reality

This chain reaction makes DOM the earliest and most actionable signal for investors.

DOM in a Rising Market

When DOM compresses (listings sell faster):

-

Buyers compete → multiple offers become common

-

Sellers gain confidence → asking prices rise

-

Developers shorten payment plans or reduce incentives

This is why falling DOM often precedes a period of price growth.

DOM in a Cooling Market

In a slowing market, developers often respond with incentives — relaxed payment plans, higher commissions to agents, and even post‑handover payment schedules — as they try to maintain absorption levels.

When DOM stretches (listings stay longer):

-

Buyers negotiate harder → low-ball offers increase

-

Sellers offer discounts or flexible terms

-

Eventually, median listing prices start to drift lower

Only later do official transaction prices reflect the drop — which is why relying solely on sales data makes you late to react.

Why DXBinteract Treats DOM as a Core Metric

Currently, there is no official public dataset in Dubai to calculate DOM precisely. At DXBinteract, we are actively building a DOM analysis feature based on real transaction timelines and listing data.

At DXBinteract, DOM is one of the highest-weighted components in both our Market Heating Score and Market Cooling Score:

-

It reacts faster than sales volume or price indexes

-

It captures sentiment shifts in near real-time

-

It predicts both upturns and downturns effectively

By monitoring DOM by area, project, and property type, we can alert investors when markets are tightening or loosening — often weeks before prices follow.

Takeaway for Investors

If you want to stay ahead of the curve, watch DOM closely:

Remember: price changes are the result — DOM is the signal that gets you there first.

Register now for early access on DXBinteract.com to be notified when our DOM analysis feature goes live — and be the first to see real-time DOM trends.