Every industry claims to be "AI-powered," and real estate is no exception. From automated valuations to intelligent chatbots, the promise sounds irresistible: feed a machine enough data, and it will forecast property prices with precision.

But here's the truth most won't say out loud—even with the best GPUs, data scientists, and algorithms, AI cannot reliably predict real estate prices, especially in dynamic markets like Dubai. Let's explore why.

1. The Validation Problem: The Past Doesn't Follow the Rules

You can't test a model on a future that hasn't happened. The common workaround—backtesting on historical data fails in real estate.

Unlike the stock market, property markets are non-stationary: the rules keep changing. Government policy shifts, migration surges, or global shocks mean a model trained on 2015–2019 data was useless in 2020.

The problem isn't just the slow feedback loop; it's that the past is an unreliable guide to the future. Deploying such a model is like driving forward while staring in the rear-view mirror.

2. Unpredictable Supply Shocks: The 2024 Example

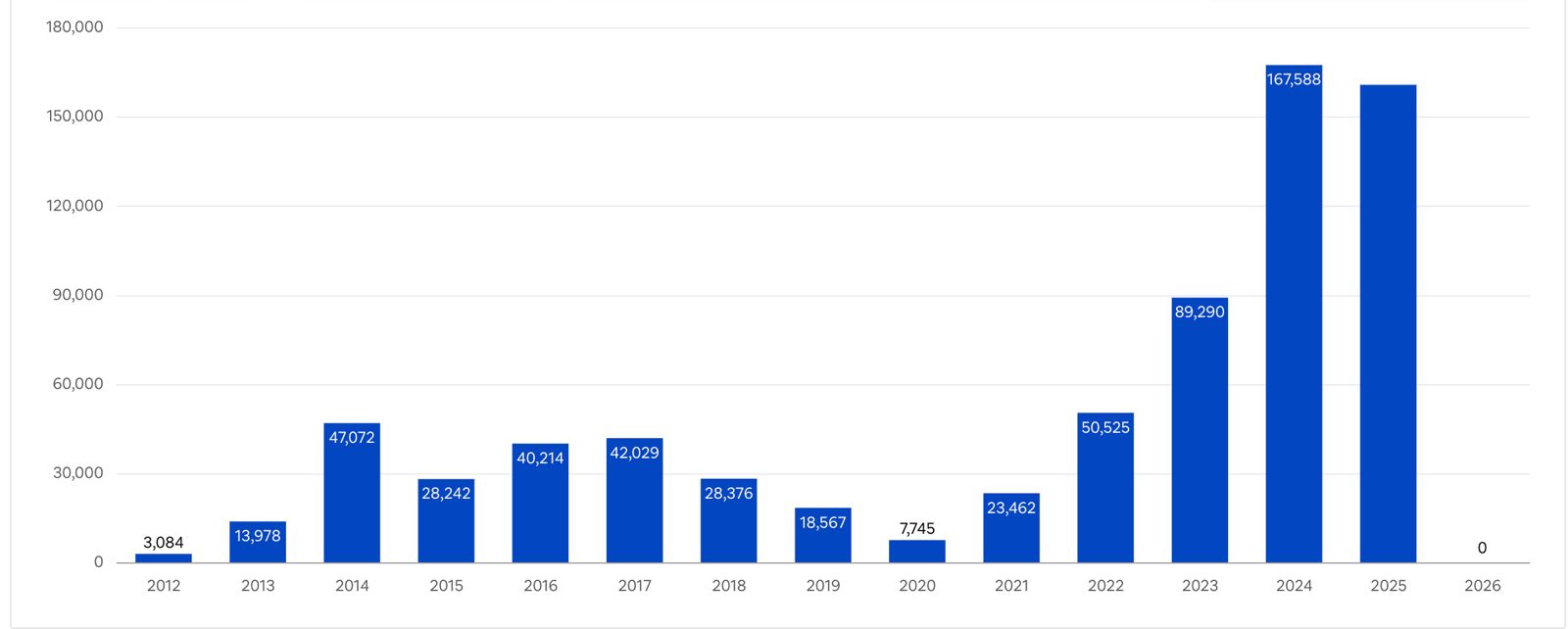

Consider Dubai's off-plan property launches. In 2023, the market saw 89,290 new unit launches. Anyone training a predictive model on historical data at that time would have no basis to anticipate what came next.

In 2024, new launches surged to 167,588 units, an 88% increase in a single year.

Some might argue that launches don't equal completions, many off-plan units won't deliver for 3–5 years. True. But that misses the point entirely. The issue isn't about predicting delivery; it's about predicting developer behavior and market sentiment. No algorithm could have foreseen this surge in launches because it was driven by developer confidence, regulatory shifts, and capital flows—none of which follow historical patterns.

Supply-side dynamics in Dubai defy historical extrapolation.

3. Even the Giants Failed: Lessons from Zillow and Opendoor

Global leaders like Zillow and Opendoor spent hundreds of millions building price-prediction engines. They had massive data, elite talent, and deep capital.

The result? Billions in losses. Zillow shut down its "Zestimate" home-buying unit after repeated mispricing.

Critics might say Zillow's failure was about iBuying (actually purchasing homes), not just predictions. But that distinction strengthens the argument: even with billions of dollars on the line and every incentive to get predictions right, they couldn't. If companies with skin in the game fail at valuation (pricing a home today) in transparent, mature markets, what chance does anyone have at forecasting (pricing a home next year) in a fast-moving market like Dubai?

4. The Human Element: The Black-Box Problem

Even the most sophisticated algorithms, XGBoost, Gradient Boosting Machines, Random Forests, depend on human assumptions about supply, interest rates, and demand. If those assumptions are wrong, the output collapses.

But AI introduces a deeper risk: the black box.

Models can learn spurious correlations, hiding their flawed logic from their own creators. An AI doesn't see reality; it sees statistical patterns. It isn't a crystal ball, it's a mirror reflecting the biases and blind spots of its data and its makers.

5. Lack of Demographic Nuance

Effective forecasting requires detailed demographic insights, age distribution, lifestyle preferences, purchasing patterns, and household composition. Without these granular inputs, AI models miss critical market nuances.

In Dubai, such demographic data is either fragmented or unavailable. Models cannot distinguish between demand from young professionals seeking studio apartments versus families looking for villas, or between end-users and investors. This demographic blindness leads to fundamentally flawed predictions.

6. The "Garbage In, Garbage Out" Rule

No model outperforms its data.

In Dubai, data is fragmented across developers, off-plan launches, and private resale records. Without consistent, verified ground truth, actual transaction data, not asking prices, models start detecting patterns in noise.

The result is precision without accuracy: a number calculated to six decimal places that means nothing at all.

7. Incomplete Insights into Income and Purchasing Power

Dubai's real estate market lacks official, centralized data on buyer income levels, employment status, and overall purchasing power. Beyond this, there is no transparent tracking of first-time home buyers, mortgage defaults, the proportion of non-resident investors, or even buyers' nationalities. These omissions create significant blind spots for any AI model:

Unknown First-Time Buyer Metrics

First-time home buyers affect demand patterns differently from repeat or seasoned investors. Without statistics on how many are entering the market, AI algorithms struggle to predict buyer behavior accurately.

No Clarity on Foreclosures

Foreclosures can flood the market with distressed properties, impacting prices. However, the lack of publicly available default mortgage data means AI forecasts might miss potential downward pressures on property values.

Untracked Non-Resident Investors

Many property transactions in Dubai involve international buyers. Yet there's no official breakdown of how many non-residents invest each year, making it difficult to assess external demand volatility.

Missing Buyer Nationality Data

A common misconception: many assume Dubai publishes buyer nationality data. It doesn't. What exists is tenant nationality data from Ejari rental contracts, an entirely different dataset. Cultural and regulatory factors differ by nationality, influencing property preferences. Without official records of buyer nationality, any demand segmentation or demographic modeling is fundamentally incomplete.

No Income/Employment Databases

Income levels and employment rates, core indicators in many real estate markets are simply not publicly available in Dubai, creating further challenges for accurate affordability analysis.

8. The AI Disruption Wildcard

There's a profound irony here: while we debate AI's ability to predict real estate prices, we're all watching to see how AI applications will reshape the job market itself.

Will AI create new jobs or displace existing ones? Economists disagree, and the outcome remains genuinely uncertain. But in Dubai, a city with a service-oriented economy and a large expatriate workforce, the stakes are particularly high. If AI displaces significant portions of the workforce, demand for affordable properties could shift dramatically. If it creates new high-paying roles, luxury demand might surge instead.

This circular dependency—where the technology we're asking to predict the market may simultaneously be reshaping it—creates yet another variable that no current model can account for. It's not a certainty; it's a wildcard. And wildcards, by definition, break predictive models.

9. The Validation Paradox: Low Velocity, High Stakes

Real estate transactions have inherently low velocity compared to financial markets. A property might change hands once every 5–10 years, meaning feedback loops are measured in years, not days.

Consider an analogy: enterprise software companies don't upgrade to a new Oracle database version until the release has been proven stable in production environments. They wait. They test. They validate. The cost of failure is too high to trust an unproven system.

Some might argue that software validation differs from market prediction. But the underlying principle is identical: high-stakes decisions require proven track records. A database crash costs millions; a wrong property investment can cost a family their life savings.

How, then, should we approach a first-of-its-kind AI model making predictions about an asset class where validation takes years? We cannot confirm whether a model's 2024 predictions were accurate until 2027 or beyond, by which point market conditions have changed entirely.

This validation paradox gives us more reasons to doubt AI predictions than to trust them. The very act of waiting to validate defeats the purpose of prediction.

10. The Mature-Market Argument: Valuation ≠ Forecasting

Critics may say, "But in Australia or the U.S., AI price predictions are fairly accurate."

That confuses valuation (what something is worth today) with forecasting (what it will be worth next year). As the Zillow example proved, even large-scale valuation is incredibly difficult.

Mature markets with decades of standardized data enable more stable models, but sentiment, policy shifts, and investor psychology still drive prices—forces no algorithm can fully learn or predict.

11. Not All AI Is Hopeless, Just Misapplied

To be clear, AI already adds value in many parts of real estate:

• Photo enhancement and content recognition

• Automated property descriptions from images

• Natural-language search that understands human queries

• Smart lead routing and agent-performance tracking

These applications make real estate smarter, not prophetic, and that distinction matters.

12. What Works Better Than Prediction

At DXBinteract, we believe the smarter path isn't predicting the future, it's understanding the present with unmatched clarity.

Our Market Intelligence Framework focuses on:

• Real-time transaction analytics

• Yield-compression signals

• Price-to-rent divergence

• Days-on-market (DOM) metrics

• Bid-weakness indicators

These don't forecast prices. They reveal market strength and direction, empowering investors to act on evidence, not speculation.

13. The Honest Investor's Advantage

While others chase prediction fantasies, successful investors stay grounded in timeless fundamentals:

• Land is finite.

• The population is rising.

• Supply takes time to adjust.

Understanding these constants, not outsourcing judgment to a black box, separates the strategic investor from the speculator.

Final Thought

AI is transforming real estate, but not as fortune-tellers promised. Its real power lies in efficiency, transparency, and insight, not prophecy.

At DXBinteract, we don't sell predictions. We build understanding.

We empower investors with clarity, truth, and data-driven confidence.

Real intelligence isn't artificial—it's revealed.