Dubai’s luxury real estate market is rewriting the global rulebook. In August 2025, the city ranked among the top three luxury property markets worldwide, outshining long-established rivals like London, New York, and Singapore.

While traditional hubs are cooling under higher taxes, financing pressures, and regulatory tightening, Dubai continues to accelerate — setting sales records, attracting new wealth, and proving itself as the benchmark for prime property investment.

Global Snapshot: Where Rivals Stand

-

London: Burdened by higher transaction costs and increased taxation, international buyers are pulling back.

-

New York: Domestic demand is healthy, but high interest rates are limiting investor appetite.

-

Singapore: Still seen as a safe haven, but supply constraints and government cooling measures are slowing momentum.

By contrast, Dubai is breaking records. Investors are drawn by favorable policies, lifestyle integration, and opportunities for strong appreciation.

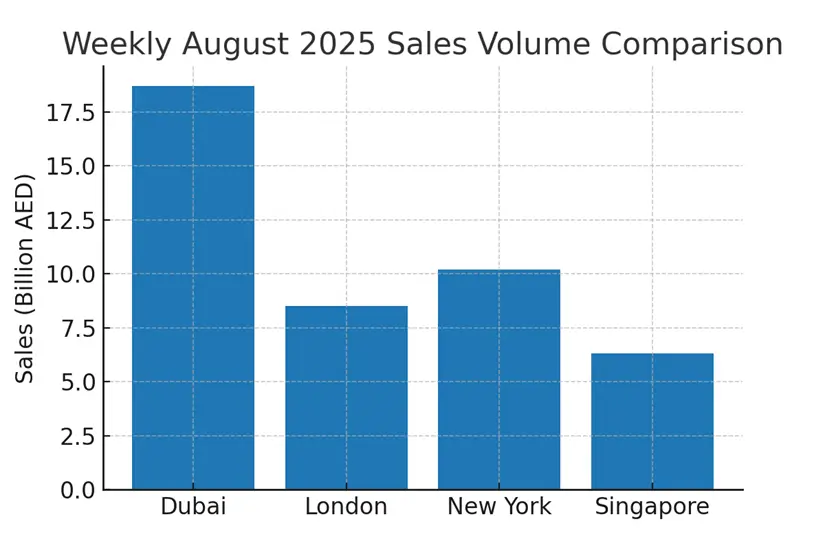

Weekly Sales Volume: Dubai Dominates

Dubai led the world in August 2025, with weekly sales volumes exceeding AED 18.6 billion. This was more than double some global rivals, highlighting the transaction depth and liquidity unique to Dubai’s luxury market.

Why Dubai Stands Apart

1. Exceptional Value for Global Investors

Even at today’s highs, Dubai luxury property remains more affordable per sq.ft. compared to London or New York. This pricing gap creates room for continued growth.

No property tax. No capital gains tax. Investors keep more of their profit, boosting net yields compared to other global hubs.

3. Residency Incentives

The Golden Visa program continues to draw long-term investors and global families, providing stability alongside property ownership.

4. Lifestyle Integration

Dubai delivers more than real estate: world-class schools, healthcare, safety, connectivity, and branded residences from Bulgari, Ritz-Carlton, and Address Hotels.

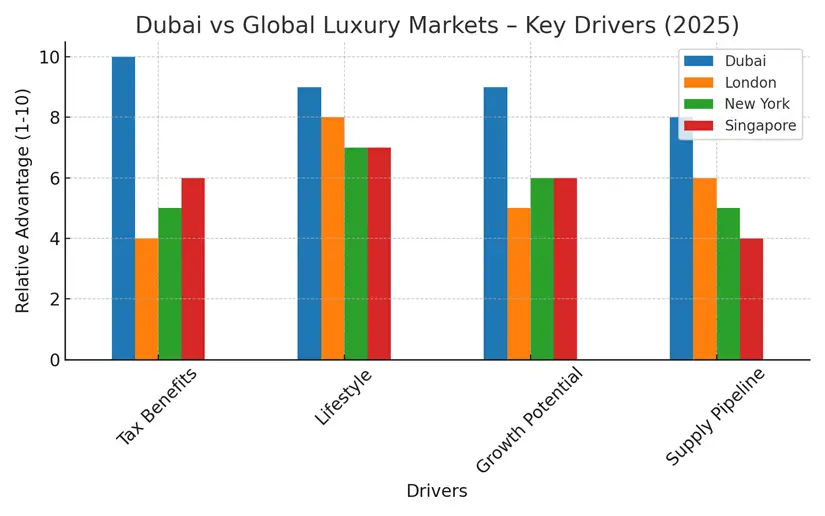

Key Drivers: Dubai vs Global Markets

Dubai outperforms across tax benefits, lifestyle appeal, and growth potential — while also offering a balanced supply pipeline that rivals like London and Singapore currently lack.

August 2025 Highlights

-

A record-breaking AED 260 million Emirates Hills villa sale ranked among the world’s most expensive property deals.

-

One week alone saw AED 18.69 billion in sales, reflecting unmatched investor confidence and liquidity.

-

Branded residences and waterfront communities dominated transactions, aligning with global trends in lifestyle-driven wealth migration.

Outlook for H2 2025

-

Price Growth: Savills forecasts a further 4%–6% rise in Dubai’s prime sector this year.

-

Supply Expansion: Over 73,000 new homes are planned for 2025, balancing supply while sustaining growth.

-

Global Positioning: As London and Singapore tighten regulations, Dubai’s investor-friendly model continues to attract migrating wealth.

What This Means for Investors

-

Dubai is no longer the “alternative market” — it’s now the global benchmark.

-

Investors benefit from lower entry prices per sq.ft. and higher net yields than rival markets.

-

The market’s resilience and transaction depth provide confidence for both short-term investors and long-term family buyers.

-

Branded residences and waterfront communities remain the hottest sectors for 2025.

Conclusion

The global conversation has shifted: investors are no longer asking “Why Dubai?” but rather “Why anywhere else?”

For those seeking growth, security, and lifestyle in one package, Dubai leads the way.

📞 Speak to a fäm Properties advisor today to explore new projects in Dubai and discover investment opportunities in the world’s most dynamic luxury real estate market.

Stay updated on Dubai’s property market with exclusive insights and new project launches on our official Telegram channel.